Show Table of Contents

The Nifty 50 opened the day at ₹22,385.69. Throughout the session, it experienced fluctuations,

hitting a low of ₹22,346.5

and reaching a high of ₹22,521.09, before finally settling at a close of ₹22,434.65 (-0.09%).

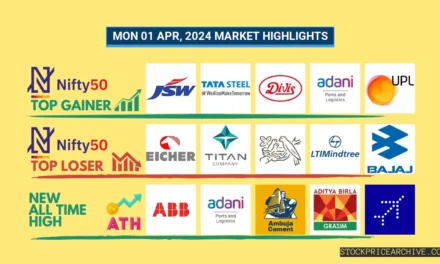

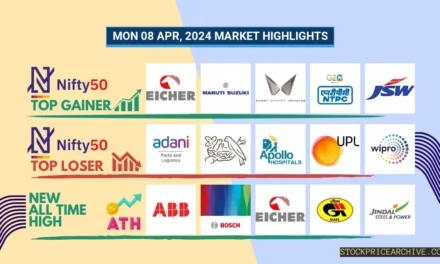

Lets take a look at the top gainers and losers stocks that influenced the today’s Nifty 50 movement.

Nifty 50 Top Gainers

Nifty 50 Top Losers

Nifty 50 Stocks To Watch for Tomorrow

➲ NTPC (Bullish Pattern)

- Performance Overview: In the last 24 trading sessions, NTPC has closed in green 14 times and in red 10 times.

- Recent Trend: NTPC has been on a 6-day green streak, without a single day

closing in red since Fri 22 Mar, 2024.

- Returns: NTPC gave a 4.5% returns in the last 24 trading sessions, that means your investment of ₹10,000 would have become ₹10450

- Financial Insight: NTPC reported a net profit of ₹5,208.87 Crore in 2023-Q3 Income Statement.

- Summary: NTPC exhibits a robust bullish pattern. Investors should monitor its price movements targets for both short-term and long-term growth prospects:

Checkout NTPC Target for Tomorrow

and NTPC Targets for 2024 & 2025.

- Performance Overview: In the last 24 trading sessions, Hero MotoCorp has closed in red 14 times and in green 10 times.

- Recent Trend: Hero MotoCorp has been on a 3-day red streak, without a single day closing in green since Thu 28 Mar, 2024.

- Returns: Hero MotoCorp gave a 1.23% returns in the last 24 trading sessions, that means your investment of 10,000 would have become 10123

- Financial Insight: Hero MotoCorp reported a net profit of 1,091.11 Crore in 2023-Q3 Income Statement.

- Summary: Hero MotoCorp is currently experiencing a bearish phase. We advise investors to keep a close watch, especially on Hero MotoCorp Target for Tomorrow

and Hero MotoCorp Targets for 2024 & 2025.

The Nifty 500 opened the day at ₹20,528.18. Throughout the session, it experienced fluctuations,

hitting a low of ₹20,497.75

and reaching a high of ₹20,657.68, before finally settling at a close of ₹20,612.55 (+0.2%).

Lets take a look at the top gainers and losers stocks that influenced the today’s Nifty 500 movement.

Nifty 500 Top Gainers

Nifty 500 Top Losers

Nifty 51 to 500 Stocks To Watch for Tomorrow

- Performance Overview: In the last 24 trading sessions, Amber Enterprises has closed in green 13 times and in red 11 times.

- Recent Trend: Amber Enterprises has been on a 9-day green streak, without a single day

closing in red since Tue 19 Mar, 2024.

- Returns: Amber Enterprises gave a -0.39% returns in the last 24 trading sessions, that means your investment of ₹10,000 would have become ₹9961

- Financial Insight: Amber Enterprises reported a net loss of ₹51.56 Lakh in 2023-Q3 Income Statement.

- Summary: Amber Enterprises exhibits a robust bullish pattern. Investors should monitor its price movements targets for both short-term and long-term growth prospects:

Checkout Amber Enterprises Target for Tomorrow

and Amber Enterprises Targets for 2024 & 2025.

➲ 3M India (Bearish Pattern)

- Performance Overview: In the last 24 trading sessions, 3M India has closed in red 14 times and in green 10 times.

- Recent Trend: 3M India has been on a 4-day red streak, without a single day closing in green since Wed 27 Mar, 2024.

- Returns: 3M India gave a -1.82% returns in the last 24 trading sessions, that means your investment of 10,000 would have become 9818

- Financial Insight: 3M India reported a net profit of 135.23 Crore in 2023-Q3 Income Statement.

- Summary: 3M India is currently experiencing a bearish phase. We advise investors to keep a close watch, especially on 3M India Target for Tomorrow

and 3M India Targets for 2024 & 2025.

Top Stocks That Created a New All Time High Today

Top Large Cap Stocks That Created a New All Time High Today

Top Mid & Small Cap Stocks That Created a New All Time High Today

Top Lesser Known Stocks That Created a New All Time High Today