Home / Fri 19 Apr 2024 Stocks To Watch

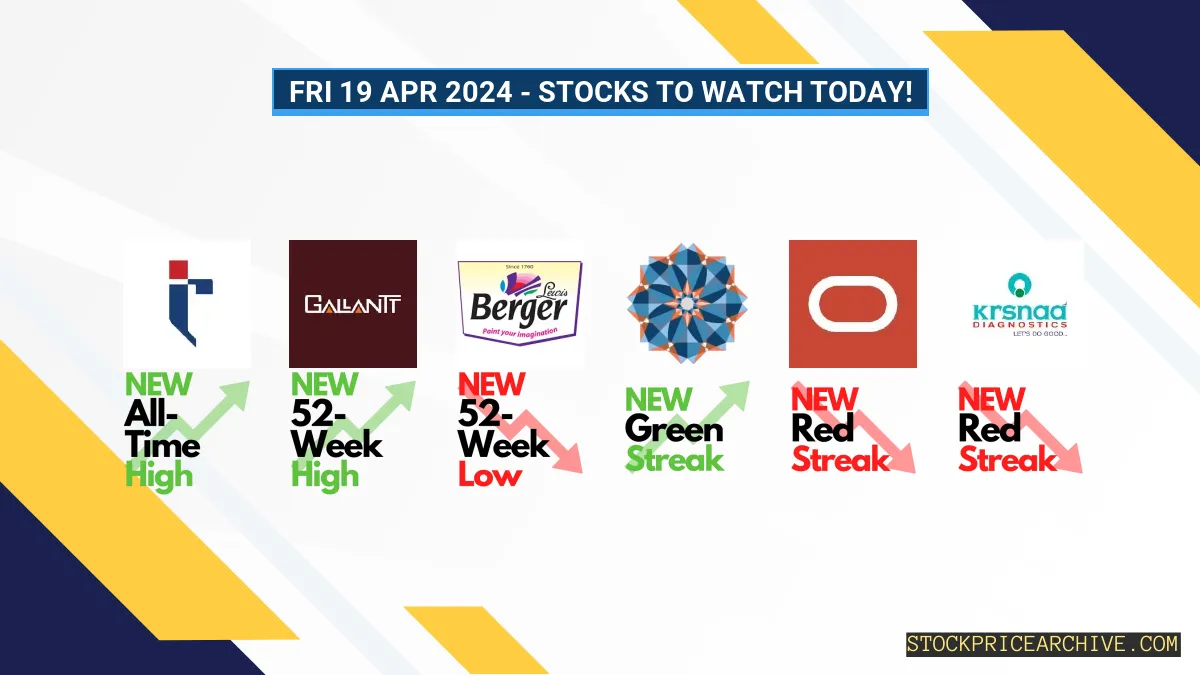

Hot Stocks To Watch Today (19 Apr 2024): TRIL, Gallantt, Berger Paints Hit Milestones Yesterday, Setting Stage for Market Surprises!

Show Table of Contents

Table of Contents

- 1: Stocks To Watch for Today!

- 1.1: ➲ TRIL (Showing Strong Bullish Trend)

- 1.2: ➲ Gallantt Metal (Showing Bullish Signs)

- 1.3: ➲ Berger Paints (Bearish Pattern)

- 1.4: Key Highlights about 21ST CENTURY MANAG

- 1.5: ➲ Learn About Oracle Financial Services Software (Showing a Bearish Pattern)

- 1.6: ➲ Krsnaa Diagnostics (Showing Bearish Pattern)

Stocks To Watch for Today!

We have identified some stocks that have potential to give big moves today.

| Company | Yesterday Close | Current Trend |

|---|---|---|

| TRIL | 632.84 (+4.99%) | Bullish: 17 Day Green Streak, Created New All-Time High |

| Gallantt Metal | 241.14 (+4.98%) | Bullish: 5 Day Green Streak, Created New 52-Week High |

| Berger Paints | 517.70 (-2.55%) | Bearish: 4 Day Red Streak, Creates New 52-Week Low |

| 21ST CENTURY MANAG | 52.30 (+1.94%) | Bullish: 12 Day Green Streak (Small Cap Stock) |

| Oracle Financial Services Software | 7750.00 (-1.38%) | Bearish: 9 Day Red Streak |

| Krsnaa Diagnostics | 583.29 (-0.24%) | Bearish: 8 Day Red Streak (Small Cap Stock) |

Why did these stocks catch our eye? Let’s delve into the compelling reasons and market trends that spotlight their potential.

➲ TRIL (Showing Strong Bullish Trend)

- TRIL hit a new all-time high (ATH) of ₹632.84 in the last trading session, surpassing its previous ATH of ₹602.75 set just 2 days ago, indicating a robust bullish momentum with buyers in control.

- Performance Summary: Out of 23 recent trading days, TRIL closed positively in 18 instances, boasting a favorable rate of 78.26%.

- Recent Trend: TRIL has maintained a 17-day winning streak since Wed 20 Mar 2024, witnessing a price surge of 103.91% to reach ₹632.84.

- Returns: Over 23 sessions, TRIL has seen a significant 87.28% growth, turning a ₹10,000 investment into ₹18,728.

- Financial Overview: In the 2023-Q3 Income Statement, TRIL reported a net profit of ₹15.72 Crore with an EPS of 1.1 for the Quarter. As of Thu 18 Apr 2024, it boasts a Market Capital of ₹8,957.56 Crore.

- Future Prospects: TRIL is currently displaying a strong bullish pattern. Investors are advised to closely track its price movements for potential growth opportunities in both the short-term and long-term. Check out TRIL’s Targets for Tomorrow and TRIL’s Targets for 2024 & 2025.

➲ Gallantt Metal (Showing Bullish Signs)

- Gallantt Metal shares hit a new 52-Week High at ₹241.14 on Thursday, surpassing the previous peak of ₹236.39 set 2 months and 13 days earlier.

- Performance Update: In the last 23 trading days, Gallantt Metal closed positively in 15 instances, achieving a success rate of 65.21%.

- Recent Trend: Without a negative close since Tue 09 Apr 2024, Gallantt Metal has maintained a 5-day winning streak, climbing 21.09% from ₹199.14 to ₹241.14.

- Returns: Over the past 23 trading days, investors gained 27.85% on Gallantt Metal, turning ₹10,000 into ₹12,785.

- Financial Highlights: Gallantt Metal reported a net profit of ₹51.97 Crore with an EPS of 2.15 in their 2023-Q3 Income Statement. The company boasts a Market Capital of ₹5,829.78 Crore as of Thu 18 Apr 2024.

- Future Prospects: With a strong bullish pattern, keep an eye on Gallantt Metal’s price movements for short and long-term growth potential. Explore Gallantt Metal’s Target for Tomorrow and 2024 & 2025 Targets.

➲ Berger Paints (Bearish Pattern)

- Berger Paints hit a fresh 52-Week Low at ₹513.75 in the latest session, breaking the previous 52-Week Low of ₹529.84 set just 2 days earlier. This indicates a strong bearish momentum, signaling that sellers are in control.

- Performance Overview: In the past 23 trading sessions, Berger Paints ended lower on 15 occasions, with a losing ratio of 65.21%.

- Recent Trend: Berger Paints has been on a 4-day losing streak since Wed 10 Apr 2024, seeing a price decline of -7.84% to ₹517.7.

- Returns: Over the last 23 days, Berger Paints registered a decline rate of -8.66%, turning ₹10,000 into ₹9,134.

- Financial Insight: According to the 2023-Q3 Income Statement, Berger Paints posted a net profit of ₹300.16 Crore with an Earning Per Share (EPS) of 2.57 for the Quarter. Additionally, as of Thu 18 Apr 2024, it holds a Market Capital of ₹60,361.4 Crore.

- Future Outlook: Berger Paints is showing a bearish pattern. Investors should keep an eye on its price movements for short-term and long-term growth opportunities. Check out Berger Paints Target for Tomorrow and Berger Paints Targets for 2024 & 2025.

Key Highlights about 21ST CENTURY MANAG

- Trading Performance: Over the past 23 trading days, 21ST CENTURY MANAG exhibited a positive trend, recording gains in 60.86% of sessions.

- Recent Trend: 21ST CENTURY MANAG has seen a 12-day bullish run, increasing its price by 25.72% to ₹52.3, without any red closures since Wed 27 Mar 2024.

- Investment Returns: With a return of 13.32% in 23 trading sessions, a ₹10,000 investment in 21ST CENTURY MANAG is now valued at ₹11,332.

- Financial Performance: In the 2023-Q3 Income Statement, 21ST CENTURY MANAG reported a net profit of ₹16.03 Crore and an EPS of 15.27. As of Thu 18 Apr 2024, its Market Capital stands at ₹54.9 Crore.

- Future Outlook: 21ST CENTURY MANAG displays a strong bullish pattern. Investors are advised to monitor its price movements closely for short and long-term growth opportunities. Explore targets for tomorrow and beyond: Check out 21ST CENTURY MANAG Target for Tomorrow and 21ST CENTURY MANAG Targets for 2024 & 2025.

➲ Learn About Oracle Financial Services Software (Showing a Bearish Pattern)

- Performance Update: Oracle Financial Services Software has displayed weakness in the market, with 16 out of the last 23 trading sessions (69.56% down days).

- Recent Movement: Since Wed 03 Apr 2024, the price of Oracle Financial Services Software has dropped by -12.32% to ₹7,750, marking a 9-day continuous decline.

- Return Analysis: Over the past 23 trading days, Oracle Financial Services Software has experienced a -7.41% loss, reducing an initial investment of ₹10,000 to ₹9,259.

- Financial Highlights: In the 2023-Q3 Income Statement, Oracle Financial Services Software disclosed a net profit of ₹740.81 Crore and an Earning Per Share (EPS) of 85.53. As of Thu 18 Apr 2024, it holds a Market Capital of ₹67,441.47 Crore.

- Looking Ahead: Oracle Financial Services Software is currently showing a bearish pattern. Investors are advised to track its price movements and explore short-term and long-term growth targets: Check out Oracle Financial Services Software’s Tomorrow’s Target as well as Oracle Financial Services Software’s 2024 & 2025 Targets.

➲ Krsnaa Diagnostics (Showing Bearish Pattern)

- Performance Overview: Krsnaa Diagnostics has been weak in the market, with 15 out of the last 23 trading sessions (65.21% ) closing below their opening prices.

- Recent Trend: In a losing streak lasting 8 days since Thu 04 Apr 2024, Krsnaa Diagnostics’ price dropped from ₹628.5 to ₹583.29, marking a -7.2% decrease.

- Returns: Over 23 days, Krsnaa Diagnostics saw a -0.97% decrease in value, turning a ₹10,000 investment into ₹9,903.

- Financial Insight: Notably, in their 2023-Q3 Income Statement, Krsnaa Diagnostics posted a net profit of ₹12.97 Crore and an Earning Per Share (EPS) of 4.09 for the Quarter. As of Thu 18 Apr 2024, its Market Capital stands at ₹1,940.41 Crore.

- Future Outlook: Krsnaa Diagnostics is currently displaying a bearish pattern. Investors are advised to closely watch its price movements for potential growth opportunities in the short and long term. Explore Krsnaa Diagnostics Target for Tomorrow and Krsnaa Diagnostics Targets for 2024 & 2025 for further insights.