Home / Mon 22 Apr 2024 Stocks To Watch

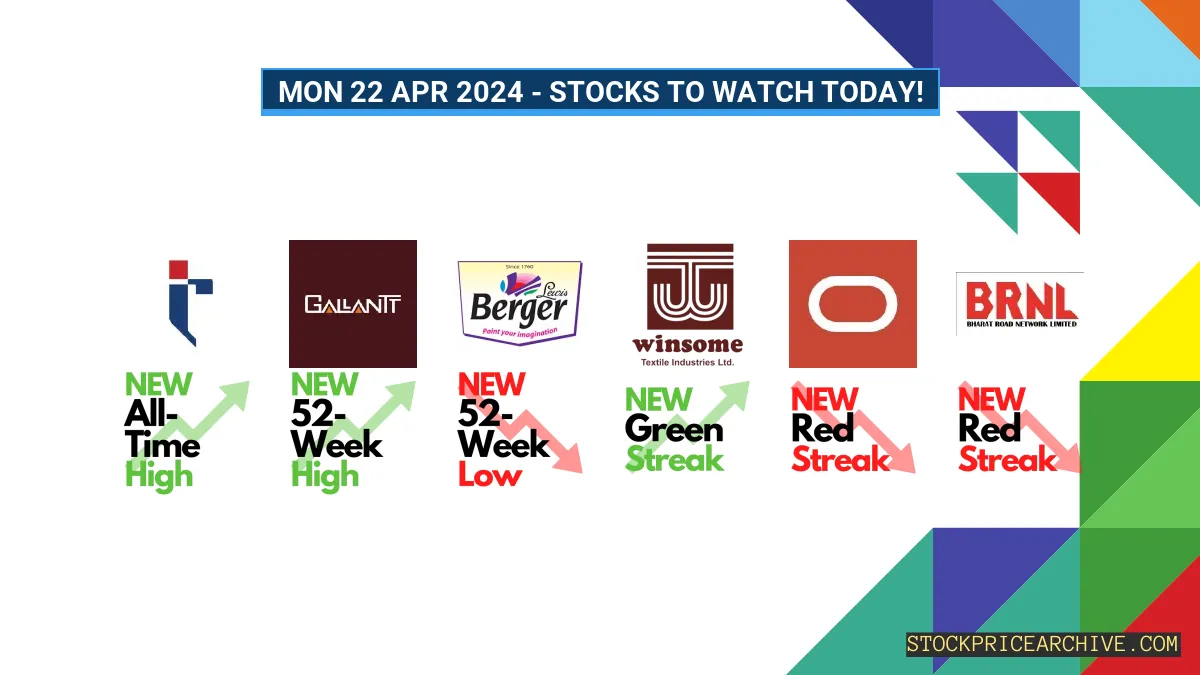

Five Stocks to Watch Today (22 Apr 2024): TRIL, Gallantt, Berger, Winsome, and Bharat Road Witness Milestones

Show Table of Contents

Stocks To Watch for Today!

We have identified some stocks that have potential to give big moves today.

| Company | Yesterday Close | Current Trend |

|---|---|---|

| TRIL | 664.45 (+4.99%) | Bullish: 18 Day Green Streak, Created New All-Time High |

| Gallantt Metal | 250.64 (+4.98%) | Bullish: 6 Day Green Streak, Created New 52-Week High |

| Berger Paints | 504.54 (-2.21%) | Bearish: 5 Day Red Streak, Creates New 52-Week Low |

| Winsome Yarns | 3.60 (+1.4%) | Bullish: 13 Day Green Streak (Small Cap Stock) |

| Oracle Financial Services Software | 7602.75 (-1.6%) | Bearish: 10 Day Red Streak |

| Bharat Road Network | 59.10 (-2%) | Bearish: 8 Day Red Streak (Small Cap Stock) |

These stocks didn’t just stumble onto our watchlist, there is an intriguing factor that made us take notice! Let’s explore.

➲ TRIL (Bullish Pattern)

- TRIL hit a record high (ATH) of ₹664.45 in its recent trading session, surpassing its previous ATH of ₹632.84 set just the day before. This bullish momentum indicates that buyers are currently in control.

- Performance Overview: Over the past 23 trading days, TRIL has enjoyed an impressive 82.6% win rate, with gains in 19 sessions.

- Recent Trend: Remarkably, TRIL has maintained a green streak for the last 18 trading days, since Wed 20 Mar 2024. This has resulted in a price surge of 114.09% to ₹664.45.

- Returns: Investors have reaped substantial rewards over the last 23 trading days, with TRIL delivering 117.88% returns, turning a hypothetical ₹10,000 investment into ₹21,788.

- Financial Insight: In its 2024-Q4 Income Statement, TRIL posted a healthy net profit of ₹41.62 Crore. As of Fri 19 Apr 2024, it boasts a Market Capital of ₹9,404.98 Crore.

- Future Outlook: TRIL’s bullish trajectory is expected to continue. Investors are advised to keep a close watch for both short-term and long-term growth opportunities: Checkout TRIL Target for Tomorrow and TRIL Targets for 2024 & 2025.

➲ Gallantt Metal (Bullish Pattern)

- On Friday, Gallantt Metal stock surged, setting a new 52-Week High of ₹250.64, surpassing the previous record set just a day before at ₹241.14. This bullish momentum indicates that buyers are currently in control of the stock.

- Performance Overview: In the past 23 trading sessions, Gallantt Metal has ended the day in the green 16 times, boasting a win ratio of 69.56%.

- Recent Trend: For 6 consecutive days since Tuesday, April 9th, 2024, Gallantt Metal has consistently closed higher, climbing 25.86% from ₹199.14 to ₹250.64.

- Returns: Gallantt Metal’s performance over 23 sessions has yielded a 40.72% growth, transforming a ₹10,000 investment into ₹14,072.

- Financial Insight: Gallantt Metal’s 2023-Q3 Income Statement reported a net profit of ₹51.97 Crore with an Earning Per Share (EPS) of 2.15 for the Quarter. As of Friday, April 19th, 2024, its Market Capital stands at ₹6,059.46 Crore.

- Future Outlook: Gallantt Metal presents a compelling bullish pattern. Investors should monitor its price movements for potential growth opportunities in both the short and long term: Checkout Gallantt Metal Target for Tomorrow and Gallantt Metal Targets for 2024 & 2025.

➲ Berger Paints (Bearish Pattern)

- Berger Paints hit a new 52-Week Low of ₹500.7 in the last trading session, breaking its previous 52-Week Low of ₹513.7 just a day earlier. This suggests strong bearish momentum, indicating that sellers are currently in control.

- Performance Overview: Berger Paints has closed in red 65.21% of the time in the last 23 trading sessions, indicating a bearish trend.

- Recent Trend: Since Wed 10 Apr 2024, Berger Paints has declined by -10.18% to ₹504.54, marking a 5-day losing streak.

- Returns: Over the past 23-day period, Berger Paints has experienced a -8.95% decline rate, dropping ₹10,000 to ₹9,105.

- Financial Overview: Berger Paints reported a net profit of ₹300.16 Crore with an Earning Per Share (EPS) of 2.57 for the 2023-Q3 Income Statement. As of Fri 19 Apr 2024, it has a Market Capital of ₹58,827 Crore.

- Future Outlook: Due to its bearish pattern, Berger Paints presents short-term and long-term growth potential. Consider checking out its Berger Paints Target for Tomorrow and Berger Paints Targets for 2024 & 2025 for more information.

➲ Winsome Yarns (Bullish Pattern)

- Performance Overview: Winsome Yarns has demonstrated resilience in the market, with 14 of the last 23 trading sessions (60.86%) closing higher than their opening values.

- Recent Trend: Winsome Yarns’s price surged by 22.03% to ₹3.6 over a 13-day bullish streak, starting from Thu 28 Mar 2024, without any day closing in red.

- Returns: Winsome Yarns’s strategy yielded a 10.76% increase over 23 days, turning a ₹10,000 stake into ₹11,076.

- Financial Insight: In their 2023-Q2 Income Statement Winsome Yarns reported a net profit of ₹2.72 Crore with Earning Per Share (EPS) of 0.38 for the Quarter. Additionally, as of Fri 19 Apr 2024, it has a Market Capital of ₹25.76 Crore.

- Future Outlook: Winsome Yarns exhibits a robust bullish pattern. Investors should monitor its price movements targets for both short-term and long-term growth prospects: Checkout Winsome Yarns Target for Tomorrow and Winsome Yarns Targets for 2024 & 2025.

➲ Oracle Financial Services Software (Bearish Pattern)

- Performance Overview: Oracle Financial Services Software has struggled in the market lately, with a 69.56% of the last 23 trading sessions closing lower than their opening values.

- Recent Trend: Starting Wed 03 Apr 2024, Oracle Financial Services Software has been on a 10-day uninterrupted losing streak, dropping from ₹8,838.29 to ₹7,602.75, a -13.98% decrease.

- Returns: Over the last 23 days, Oracle Financial Services Software’s strategy resulted in a -4.97% decrease, reducing a ₹10,000 stake to ₹9,503.

- Financial Insight: In their 2023-Q3 Income Statement Oracle Financial Services Software reported an impressive net profit of ₹740.81 Crore with an Earning Per Share (EPS) of 85.53 for the Quarter. As of Fri 19 Apr 2024, it has a strong Market Capital of ₹66,160.08 Crore.

- Future Outlook: Oracle Financial Services Software exhibits a bearish pattern. Investors should monitor its price movements and consider their investment strategies accordingly. Checkout Oracle Financial Services Software Target for Tomorrow and Oracle Financial Services Software Targets for 2024 & 2025 for potential price targets.

➲ Bharat Road Network (Bearish Pattern)

- Performance Overview: Over a period of 23 trading days, Bharat Road Network closed in the red 12 times, resulting in a 52.17% frequency of negative sessions.

- Recent Trend: Since 05 April 2024, Bharat Road Network has experienced an unbroken string of red closes, totaling 8 consecutive days. This has led to a decline of -14.72% in its share price, bringing it down to ₹59.1.

- Returns: Investors who invested in Bharat Road Network over the past 23 trading days have faced a 5.53% loss, shrinking an initial investment of ₹10,000 to ₹10,552.99.

- Financial Snapshot: Bharat Road Network’s 2023-Q3 Income Statement revealed a net loss of ₹10.3 Crore, with an Earnings Per Share (EPS) of -1.873365 for the quarter. As of 19 April 2024, the company possesses a Market Capital of ₹496.14 Crore.

- Outlook: Bharat Road Network currently displays a bearish trend. Investors are advised to keep a close watch on its price movements, particularly regarding its short-term and long-term growth potential. Explore Bharat Road Network’s Target for Tomorrow and Bharat Road Network’s Targets for 2024 & 2025 to stay informed.