Home / Mon 01 Apr 2024 Market Highlights Bajaj Finances Bullish Streak Green Streak Continues To 8 Day Rally

MON 01 APR, 2024 MARKET HIGHLIGHTS: Bajaj Finance’s Bullish Trend: Green Streak Continues to 8-Day Rally

Show Table of Contents

Table of Contents

- 1: Top Indices Performance Overview

- 2: Nifty 50 Performance Overview

- 2.1: Nifty 50 Top Gainers

- 2.2: Nifty 50 Top Losers

- 2.3: Nifty 50 Stocks To Watch for Tomorrow

- 2.3.1: ➲ Bajaj Finance (Bullish Pattern)

- 2.3.2: ➲ Tech Mahindra (Bearish Pattern)

- 3: Nifty 500 Performance Overview

- 3.1: Nifty 500 Top Gainers

- 3.2: Nifty 500 Top Losers

- 3.3: Nifty 500 Stocks To Watch for Tomorrow

- 3.3.1: ➲ Bajaj Finance (Bullish Pattern)

- 3.3.2: ➲ Vinati Organics (Bearish Pattern)

Top Indices Performance Overview

| Stock | Close | Range |

|---|---|---|

| NIFTY 50 | ₹22,469.05 (0.63%) | ₹22,427.75 – ₹22,529.95 |

| NIFTY BANK | ₹47,558.70 (0.92%) | ₹47,391.05 – ₹47,643 |

| NIFTY FIN SERVICE | ₹21,182.15 (0.91%) | ₹21,106.55 – ₹21,236.50 |

| NIFTY IT | ₹35,089.20 (0.54%) | ₹34,966.45 – ₹35,264.60 |

| NIFTY AUTO | ₹21,385.25 (-0.16%) | ₹21,338.65 – ₹21,630.55 |

| NIFTY ENERGY | ₹39,489.70 (1.2%) | ₹39,227.85 – ₹39,557.30 |

Nifty 50 Performance Overview

The Nifty 50 opened the day at ₹22,455. Throughout the session, it experienced fluctuations, hitting a low of ₹22,427.75 and reaching a high of ₹22,529.95, before finally settling at a close of ₹22,469.05 (+0.63%).

Lets take a look at the top gainers and losers stocks that influenced the today’s Nifty 50 movement.

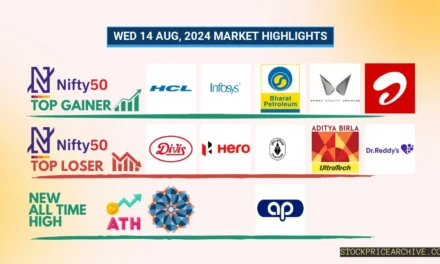

Nifty 50 Top Gainers

| Stock | Close | Range |

|---|---|---|

| JSW Steel | ₹870.50 (4.85%) | ₹838 – ₹876.45 |

| Tata Steel | ₹162.80 (4.45%) | ₹156.50 – ₹163.90 |

| Divis Lab | ₹3,575.50 (3.77%) | ₹3,450 – ₹3,590 |

| Adani Ports | ₹1,378.45 (2.72%) | ₹1,351.65 – ₹1,381.55 |

| UPL | ₹466.20 (2.23%) | ₹458.45 – ₹468.35 |

Nifty 50 Top Losers

| Stock | Close | Range |

|---|---|---|

| Eicher Motors | ₹3,947 (-1.8%) | ₹3,936.50 – ₹4,070 |

| TITAN | ₹3,745.95 (-1.47%) | ₹3,730.50 – ₹3,832.55 |

| Nestle India | ₹2,589.95 (-1.24%) | ₹2,582.50 – ₹2,642.60 |

| LTIMindtree | ₹4,890 (-0.99%) | ₹4,866.10 – ₹4,979.75 |

| Bajaj Auto | ₹9,062.55 (-0.94%) | ₹9,013.10 – ₹9,211.60 |

Nifty 50 Stocks To Watch for Tomorrow

➲ Bajaj Finance (Bullish Pattern)

- Performance Overview: In the last 23 trading sessions, Bajaj Finance has closed in green 15 times and in red 8 times.

- Recent Trend: Bajaj Finance has been on a 8-day green streak, without a single day closing in red since Mon 18 Mar, 2024.

- Returns: Bajaj Finance gave a 8.38% returns in the last 23 trading sessions, that means your investment of ₹10,000 would have become ₹10,838

- Financial Insight: Bajaj Finance reported a net profit of ₹3,638.95 Crore in 2023-Q3 Income Statement.

- Summary: Bajaj Finance exhibits a robust bullish pattern. Investors should monitor its price movements targets for both short-term and long-term growth prospects: Checkout Bajaj Finance Target for Tomorrow and Bajaj Finance Targets for 2024 & 2025.

➲ Tech Mahindra (Bearish Pattern)

- Performance Overview: In the last 23 trading sessions, Tech Mahindra has closed in red 16 times and in green 7 times.

- Recent Trend: Tech Mahindra has been on a 5-day red streak, without a single day closing in green since Thu 21 Mar, 2024.

- Returns: Tech Mahindra gave a -5.9% returns in the last 23 trading sessions, that means your investment of 10,000 would have become 9,410

- Financial Insight: Tech Mahindra reported a net profit of 523.70 Crore in 2023-Q3 Income Statement.

- Summary: Tech Mahindra is currently experiencing a bearish phase. We advise investors to keep a close watch, especially on Tech Mahindra Target for Tomorrow and Tech Mahindra Targets for 2024 & 2025.

Nifty 500 Performance Overview

The Nifty 500 opened the day at ₹20,392.25. Throughout the session, it experienced fluctuations, hitting a low of ₹20,392.25 and reaching a high of ₹20,504.45, before finally settling at a close of ₹20,496.50 (+1.19%).

Lets take a look at the top gainers and losers stocks that influenced the today’s Nifty 500 movement.

Nifty 500 Top Gainers

| Stock | Close | Range |

|---|---|---|

| Delta Corp | ₹124.40 (12.42%) | ₹112.25 – ₹126.05 |

| Welspun India | ₹154.60 (12.35%) | ₹139.20 – ₹156.40 |

| KRBL | ₹310.30 (11.88%) | ₹281.35 – ₹313.70 |

| NMDC Steel | ₹61.05 (11.6%) | ₹55.15 – ₹61.90 |

| Sterlite Technologies | ₹123.50 (11.46%) | ₹112 – ₹124.45 |

Nifty 500 Top Losers

| Stock | Close | Range |

|---|---|---|

| CG Power | ₹514.25 (-4.93%) | ₹511.10 – ₹555.30 |

| Kaynes Technology | ₹2,788 (-2.93%) | ₹2,768.85 – ₹2,869.95 |

| Finolex Cables | ₹974 (-2.7%) | ₹969 – ₹1,014 |

| Sona BLW Precision Forgings | ₹688 (-2.55%) | ₹682.90 – ₹714 |

| CreditAccess Grameen | ₹1,408.70 (-2.27%) | ₹1,400.30 – ₹1,455.50 |

Nifty 500 Stocks To Watch for Tomorrow

➲ Bajaj Finance (Bullish Pattern)

- Performance Overview: In the last 23 trading sessions, Bajaj Finance has closed in green 15 times and in red 8 times.

- Recent Trend: Bajaj Finance has been on a 8-day green streak, without a single day closing in red since Mon 18 Mar, 2024.

- Returns: Bajaj Finance gave a 8.38% returns in the last 23 trading sessions, that means your investment of ₹10,000 would have become ₹10,838

- Financial Insight: Bajaj Finance reported a net profit of ₹3,638.95 Crore in 2023-Q3 Income Statement.

- Summary: Bajaj Finance exhibits a robust bullish pattern. Investors should monitor its price movements targets for both short-term and long-term growth prospects: Checkout Bajaj Finance Target for Tomorrow and Bajaj Finance Targets for 2024 & 2025.

➲ Vinati Organics (Bearish Pattern)

- Performance Overview: In the last 23 trading sessions, Vinati Organics has closed in red 18 times and in green 5 times.

- Recent Trend: Vinati Organics has been on a 8-day red streak, without a single day closing in green since Mon 18 Mar, 2024.

- Returns: Vinati Organics gave a -11.49% returns in the last 23 trading sessions, that means your investment of 10,000 would have become 8,851

- Financial Insight: Vinati Organics reported a net profit of 76.94 Crore in 2023-Q3 Income Statement.

- Summary: Vinati Organics is currently experiencing a bearish phase. We advise investors to keep a close watch, especially on Vinati Organics Target for Tomorrow and Vinati Organics Targets for 2024 & 2025.