Home / Fri 03 May 2024 Market Recap

03 May 2024: Nifty 50 closed at ₹22,456.05 (-0.85%). Ashok Leyland, Coal India, Bharti Airtel, & Hero MotoCorp Made New Milestones

Show Table of Contents

Table of Contents

- 1: Top Indices Performance Overview

- 2: Nifty 50 Performance Overview

- 2.1: Nifty 50 Top Gainers

- 2.2: Nifty 50 Top Losers

- 2.3: Nifty 50 Stocks To Watch for Tomorrow

- 3: Nifty 500 Performance Overview

- 3.1: Nifty 500 Top Gainers

- 3.2: Nifty 500 Top Losers

- 3.3: Nifty 51 to 500 Stocks To Watch for Tomorrow

- 3.3.1: ➲ Ashok Leyland (Bullish Pattern)

- 3.3.2: ➲ Allcargo Logistics (Bearish Pattern)

- 4: Top Stocks That Created a New All Time High Today

- 4.1: Top Large Cap Stocks That Created a New All Time High Today

- 4.2: Top Mid Cap Stocks That Created a New All Time High Today

- 4.3: Top Small Cap Stocks That Created a New All Time High Today

Top Indices Performance Overview

| Stock | Close | Range |

|---|---|---|

| NIFTY 50 | ₹22,456.05 (-0.85%) | ₹22,348.84 – ₹22,793.9 |

| NIFTY BANK | ₹48,877.85 (-0.72%) | ₹48,662.94 – ₹49,596.75 |

| NIFTY FIN SERVICE | ₹21,769.55 (-0.48%) | ₹21,708.15 – ₹22,135.9 |

| NIFTY IT | ₹32,887.89 (-0.96%) | ₹32,690.59 – ₹33,300.25 |

| NIFTY AUTO | ₹22,533.25 (-0.89%) | ₹22,342.59 – ₹22,863.19 |

| NIFTY ENERGY | ₹40,575.19 (-0.56%) | ₹40,124.5 – ₹41,242.1 |

Nifty 50 Performance Overview

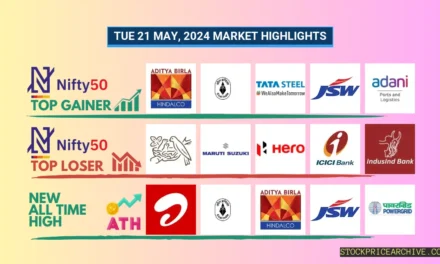

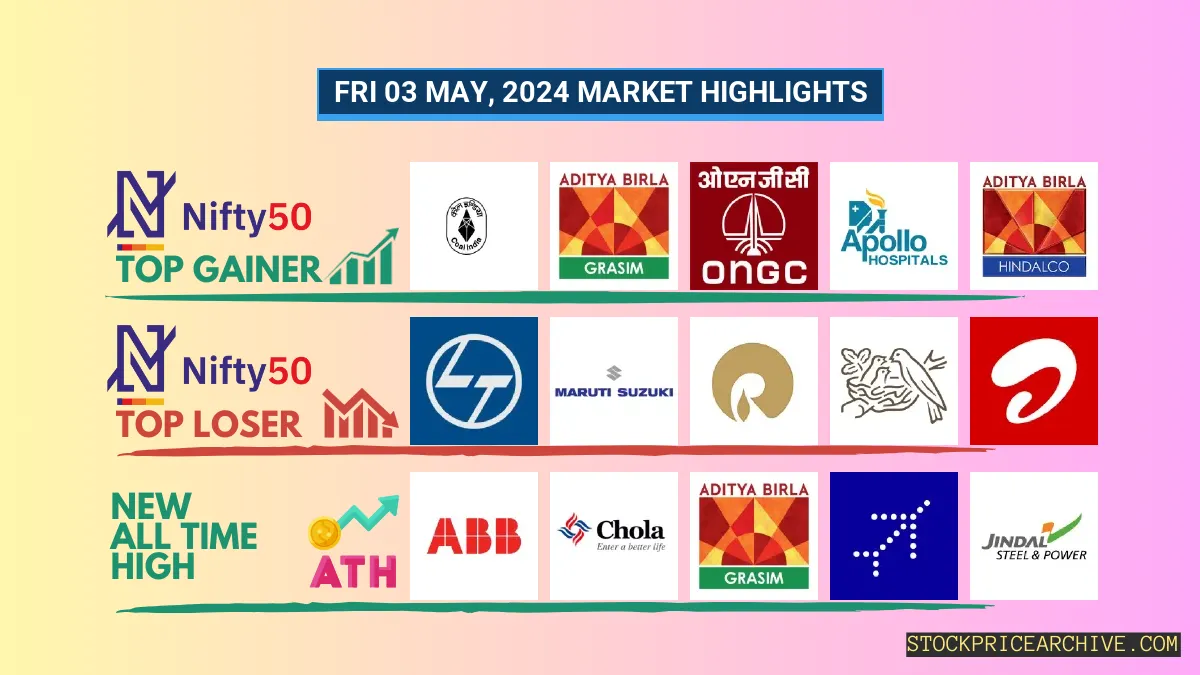

The Nifty 50 opened the day at a robust ₹22,772.55. During the session, it faced fluctuations, reaching a low of ₹22,348.84 and a high of ₹22,793.9. Finally, it settled at ₹22,456.05, marking a 0.85% decline from the opening price.Let’s explore the top gainers and losers that shaped the Nifty 50’s movement today.Nifty 50 Top Gainers

| Stock | Close | Range |

|---|---|---|

| Coal India | ₹475.5 (4.76%) | ₹449.45 – ₹475.7 |

| GRASIM | ₹2484 (1.91%) | ₹2,438.8 – ₹2,486.94 |

| ONGC | ₹286.1 (1.17%) | ₹284.1 – ₹292.95 |

| Apollo Hospitals | ₹6005 (0.77%) | ₹5961 – ₹6,026.75 |

| Hindalco | ₹646.09 (0.72%) | ₹638.54 – ₹652.04 |

Nifty 50 Top Losers

| Stock | Close | Range |

|---|---|---|

| Larsen Toubro | ₹3,499.75 (-2.78%) | ₹3,488.85 – ₹3,614.14 |

| Maruti Suzuki | ₹12480 (-2.55%) | ₹12,415.4 – ₹12820 |

| Reliance Industries | ₹2,869.19 (-2.18%) | ₹2,832.89 – ₹2,949.8 |

| Nestle India | ₹2,459.94 (-2.09%) | ₹2,436.25 – ₹2,523.05 |

| Bharti Airtel | ₹1278 (-2%) | ₹1,258.19 – ₹1,308.15 |

Nifty 50 Stocks To Watch for Tomorrow

Nifty 500 Performance Overview

The Nifty 500 commenced trading at ₹21,192.59. It fluctuated between a low of ₹20,831.05 and a high of ₹21,208.15 before settling at ₹20,948.34, a 0.65% decline.

Key contributors to this movement included:

Nifty 500 Top Gainers

| Stock | Close | Range |

|---|---|---|

| Hindustan Zinc | ₹470.6 (8.9%) | ₹441.45 – ₹477.89 |

| Blue Dart | ₹6,745.89 (8.08%) | ₹6,244.79 – ₹6899 |

| Ajanta Pharma | ₹2372 (6.17%) | ₹2365 – ₹2500 |

| Rainbow Childrens Medicare | ₹1464 (5.33%) | ₹1,398.05 – ₹1,489.25 |

| Piramal Pharma | ₹150.94 (5.29%) | ₹143.25 – ₹153.88 |

Nifty 500 Top Losers

| Stock | Close | Range |

|---|---|---|

| Coforge | ₹4485 (-10.05%) | ₹4,461.45 – ₹4,713.04 |

| Sun Pharma Advanced Research Company | ₹225.5 (-5%) | ₹225.5 – ₹239.5 |

| Carborundum | ₹1443 (-4.23%) | ₹1,425.09 – ₹1509 |

| MRF | ₹128400 (-4.09%) | ₹127790 – ₹1,33,862.04 |

| SRF | ₹2,569.55 (-3.73%) | ₹2,535.6 – ₹2,691.14 |

Nifty 51 to 500 Stocks To Watch for Tomorrow

➲ Ashok Leyland (Bullish Pattern)

- Performance Overview: In the last 23 trading sessions, Ashok Leyland has closed in green 16 times and in red 7 times.

- Recent Trend: Ashok Leyland has been on a 9-day green streak, without a single day closing in red since Fri 19 Apr 2024.

- Returns: Ashok Leyland gave a 18.48% returns in the last 23 trading sessions, that means your investment of ₹10,000 would have become ₹11,848

- Financial Insight: Ashok Leyland reported a net profit of ₹608.85 Crore in 2023-Q3 Income Statement.

- As of Fri 03 May 2024, Ashok Leyland has a Market Capital of ₹54,351.33 Crore.

- Summary: Ashok Leyland exhibits a robust bullish pattern. Investors should monitor its price movements targets for both short-term and long-term growth prospects: Checkout Ashok Leyland Target for Tomorrow and Ashok Leyland Targets for 2024 & 2025.

Ashok Leyland Financial Performance

| Metric | Value | Description |

|---|---|---|

| Revenue Growth (Quarterly) | +6.7% | Change in revenue compared to the previous quarter. |

| Earnings Growth (YOY Quarterly) | +75.59% | Change in earnings compared to the same quarter last year. |

| Operating Margin | 15.5% | Income from operations as a percentage of revenue, before taxes and interest. |

| Profit Margin | 5.24% | Net income as a percentage of revenue, after all expenses. |

| Debt-to-Equity (D/E) Ratio | 306.52 | Company’s total debt divided by total shareholder equity. |

| Beta | 0.86 | Beta is less than 1 indicating that the Ashok Leyland’s price is less volatile than the market. |

➲ Allcargo Logistics (Bearish Pattern)

- Performance Overview: In the last 23 trading sessions, Allcargo Logistics has closed in red 12 times and in green 11 times.

- Recent Trend: Allcargo Logistics has been on a 6-day red streak, without a single day closing in green since Wed 24 Apr 2024.

- Returns: Allcargo Logistics gave a -1.51% returns in the last 23 trading sessions, that means your investment of ₹10,000 would have become ₹9,849

- Financial Insight: Allcargo Logistics reported a net profit of 17.36 Crore in 2023-Q3 Income Statement.

- As of Fri 03 May 2024, Ashok Leyland has a Market Capital of ₹7,282.41 Crore.

- Summary: Allcargo Logistics is currently experiencing a bearish phase. We advise investors to keep a close watch, especially on Allcargo Logistics Target for Tomorrow and Allcargo Logistics Targets for 2024 & 2025.

Allcargo Logistics Financial Performance

| Metric | Value | Description |

|---|---|---|

| Revenue Growth (Quarterly) | +111.9% | Change in revenue compared to the previous quarter. |

| Earnings Growth (YOY Quarterly) | +298.3% | Change in earnings compared to the same quarter last year. |

| Operating Margin | 5.6% | Income from operations as a percentage of revenue, before taxes and interest. |

| Profit Margin | 1.64% | Net income as a percentage of revenue, after all expenses. |

| Debt-to-Equity (D/E) Ratio | 0.65 | Company’s total debt divided by total shareholder equity. |

| Beta | 0.8 | Beta is less than 1 indicating that the Allcargo Logistics’s price is less volatile than the market. |

Top Stocks That Created a New All Time High Today

Top Large Cap Stocks That Created a New All Time High Today

Companies with Market Capital more than 20,000 Crores| Stock | Close | New All-Time High (ATH) | Previous ATH | Previous ATH Date |

|---|---|---|---|---|

| ABB India | 6698.85 (+0.24%) | 6788.85 (+0.6%) | 6747.89 | Mon 08 Apr 2024 |

| Ajanta Pharma | 2372.00 (+6.17%) | 2500.00 (+%) | Thu 01 Jan 1970 | |

| Apar Industries | 7939.25 (-0.89%) | 8142.14 (+3.72%) | 7850.00 | Wed 24 Apr 2024 |

| Ashok Leyland | 202.25 (+0.44%) | 205.05 (+%) | Thu 01 Jan 1970 | |

| Cholamandalam | 1310.00 (+0.64%) | 1351.34 (+%) | Thu 01 Jan 1970 |

Top Mid Cap Stocks That Created a New All Time High Today

Companies with Market Capital between 5,000 Crores to 20,000 Crores| Stock | Close | New All-Time High (ATH) | Previous ATH | Previous ATH Date |

|---|---|---|---|---|

| BASF | 4100.00 (+2.13%) | 4100.00 (+%) | Thu 01 Jan 1970 | |

| CMS Info Systems | 417.54 (-2.11%) | 434.95 (+%) | Thu 01 Jan 1970 | |

| Gallantt Metal | 326.00 (+4.95%) | 326.10 (+18.02%) | 276.29 | Tue 23 Apr 2024 |

| Ingersoll Rand | 3985.00 (-1.14%) | 4076.80 (+1.41%) | 4020.10 | Thu 18 Apr 2024 |

| INOX India | 1390.65 (+2.39%) | 1473.00 (+%) | Thu 01 Jan 1970 |

Top Small Cap Stocks That Created a New All Time High Today

Companies with Market Capital less than 5,000 Crores| Stock | Close | New All-Time High (ATH) | Previous ATH | Previous ATH Date |

|---|---|---|---|---|

| Aartech Solonics Ltd | 259.00 (+2.81%) | 262.00 (+%) | Thu 01 Jan 1970 | |

| Aayush Food and Herbs | 259.00 (-0.39%) | 263.00 (+8.52%) | 242.35 | Thu 25 Apr 2024 |

| ABIRAFN | 63.50 (+4.99%) | 63.50 (+27.58%) | 49.77 | Thu 25 Apr 2024 |

| ASM Technologies | 1186.00 (-2.62%) | 1260.00 (+5.81%) | 1190.80 | Wed 24 Apr 2024 |

| Auro Laboratories | 278.70 (+9.98%) | 278.70 (+32.9%) | 209.70 | Wed 24 Apr 2024 |