Home / Tue 30 Apr 2024 Market Recap

Nifty closes at ₹22,604.84 with a slight dip, but Axis Bank & Ashok Leyland soar, setting new all-time highs. 4 Top Stocks To Watch For Tomorrow!

Show Table of Contents

Table of Contents

- 1: Top Indices Performance Overview

- 2: Nifty 50 Performance Overview

- 2.1: Nifty 50 Top Gainers

- 2.2: Nifty 50 Top Losers

- 2.3: Nifty 50 Stocks To Watch for Tomorrow

- 2.3.1: ➲ Axis Bank (Bullish Pattern)

- 2.3.2: ➲ Apollo Hospitals (Bearish Pattern)

- 3: Nifty 500 Performance Overview

- 3.1: Nifty 500 Top Gainers

- 3.2: Nifty 500 Top Losers

- 3.3: Nifty 51 to 500 Stocks To Watch for Tomorrow

- 3.3.1: ➲ Ashok Leyland (Bullish Pattern)

- 3.3.2: ➲ Aster Healthcare (Bearish Pattern)

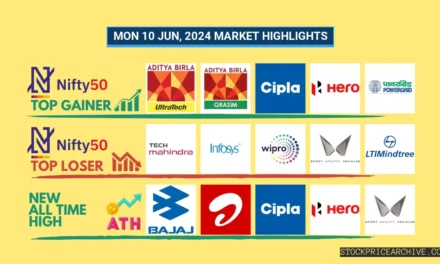

- 4: Top Stocks That Created a New All Time High Today

- 4.1: Top Large Cap Stocks That Created a New All Time High Today

- 4.2: Top Mid Cap Stocks That Created a New All Time High Today

- 4.3: Top Small Cap Stocks That Created a New All Time High Today

Top Indices Performance Overview

| Stock | Close | Range |

|---|---|---|

| NIFTY 50 | ₹22,604.84 (-0.18%) | ₹22,568.4 – ₹22,783.34 |

| NIFTY BANK | ₹49,396.75 (-0.06%) | ₹49,249.89 – ₹49,974.75 |

| NIFTY FIN SERVICE | ₹21,841.15 (0.13%) | ₹21,779.19 – ₹22,073.69 |

| NIFTY IT | ₹33,212.05 (-1.1%) | ₹33,146.75 – ₹33,688.5 |

| NIFTY AUTO | ₹22,488.44 (1.85%) | ₹22,186.75 – ₹22,632.75 |

| NIFTY ENERGY | ₹40,355.3 (0%) | ₹40,312.75 – ₹40,771.35 |

Nifty 50 Performance Overview

Nifty 50 faced volatility today, swinging between a low of ₹22,568.4 and a high of ₹22,783.34 before closing at ₹22,604.84, marking a slight decline of 0.18%.

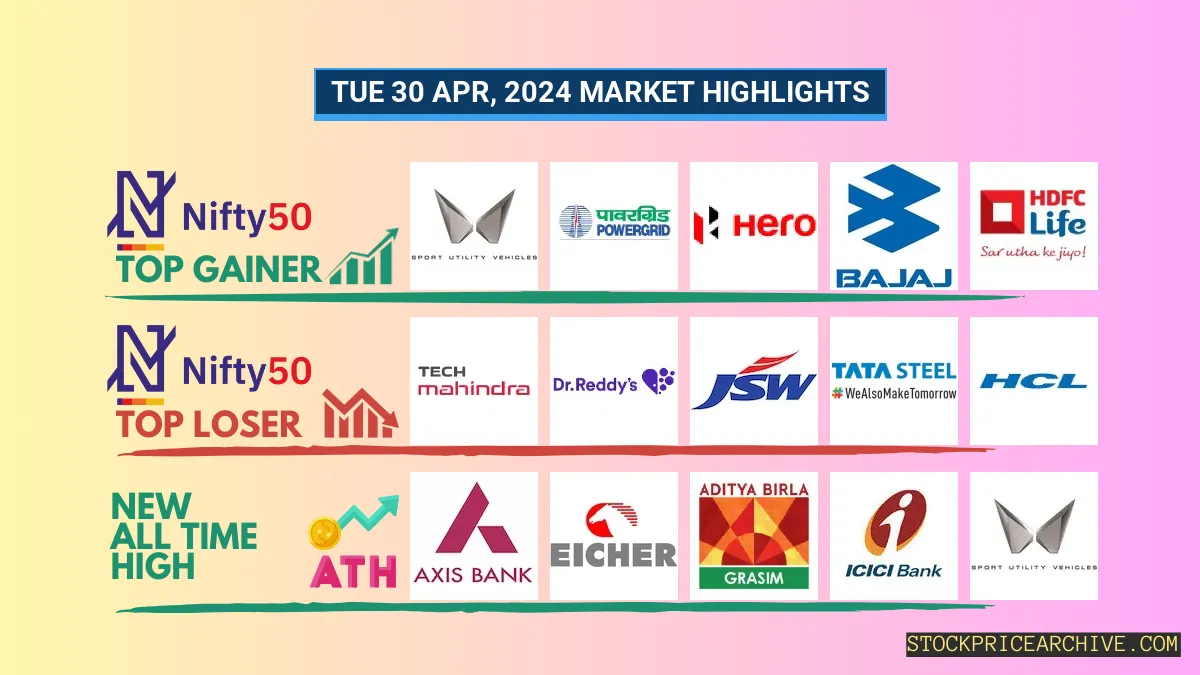

Nifty 50 Top Gainers

| Stock | Close | Range |

|---|---|---|

| Mahindra & Mahindra | ₹2,156.35 (4.57%) | ₹2,073.05 – ₹2169 |

| Power Grid | ₹302 (2.82%) | ₹293.04 – ₹304.35 |

| Hero MotoCorp | ₹4,550.35 (2.07%) | ₹4,465.04 – ₹4,587.25 |

| Bajaj Auto | ₹8,918.7 (1.81%) | ₹8800 – ₹8,965.95 |

| HDFC Life | ₹584.29 (1.59%) | ₹576.75 – ₹588.5 |

Nifty 50 Top Losers

| Stock | Close | Range |

|---|---|---|

| Tech Mahindra | ₹1,263.5 (-1.93%) | ₹1,260.05 – ₹1,291.08 |

| Dr Reddy Lab | ₹6,193.6 (-1.65%) | ₹6,189.04 – ₹6,310.75 |

| JSW Steel | ₹882.2 (-1.52%) | ₹880.04 – ₹902.75 |

| Tata Steel | ₹165 (-1.43%) | ₹164.5 – ₹168.39 |

| HCL | ₹1,367.9 (-1.41%) | ₹1,362.84 – ₹1,397.8 |

Nifty 50 Stocks To Watch for Tomorrow

➲ Axis Bank (Bullish Pattern)

- Performance Overview: In the last 23 trading sessions, Axis Bank has closed in green 16 times and in red 7 times.

- Recent Trend: Axis Bank has been on a 7-day green streak, without a single day closing in red since Thu 18 Apr 2024

- Returns: Axis Bank gave a 13.03% returns in the last 23 trading sessions, that means your investment of ₹10,000 would have become ₹11,303

- Financial Insight: Axis Bank reported a net profit of ₹6,519.5 Crore in 2023-Q3 Income Statement.

- As of Tue 30 Apr 2024, Axis Bank has a Market Capital of ₹3,48,951.88 Crore.

- Summary: Axis Bank exhibits a robust bullish pattern. Investors should monitor its price movements targets for both short-term and long-term growth prospects: Checkout Axis Bank Target for Tomorrow and Axis Bank Targets for 2024 & 2025.

Axis Bank Financial Performance

| Metric | Value | Description |

|---|---|---|

| Revenue Growth (Quarterly) | +110.1% | Change in revenue compared to the previous quarter. |

| Earnings Growth (YOY Quarterly) | +20.31% | Change in earnings compared to the same quarter last year. |

| Operating Margin | 50.19% | Income from operations as a percentage of revenue, before taxes and interest. |

| Profit Margin | 36.43% | Net income as a percentage of revenue, after all expenses. |

| Debt-to-Equity (D/E) Ratio | 1.44 | Company’s total debt divided by total shareholder equity. |

| Beta | 0.88 | Beta is less than 1 indicating that the Axis Bank’s price is less volatile than the market. |

➲ Apollo Hospitals (Bearish Pattern)

- Performance Overview: In the last 23 trading sessions, Apollo Hospitals has closed in red 14 times and in green 9 times.

- Recent Trend: Apollo Hospitals has been on a 3-day red streak, without a single day closing in green since Thu 25 Apr 2024

- Returns: Apollo Hospitals gave a -7.01% returns in the last 23 trading sessions, that means your investment of ₹10,000 would have become ₹9,299

- Financial Insight: Apollo Hospitals reported a net profit of 254.4 Crore in 2023-Q3 Income Statement.

- As of Tue 30 Apr 2024, Axis Bank has a Market Capital of ₹89,989.27 Crore.

- Summary: Apollo Hospitals is currently experiencing a bearish phase. We advise investors to keep a close watch, especially on Apollo Hospitals Target for Tomorrow and Apollo Hospitals Targets for 2024 & 2025.

Apollo Hospitals Financial Performance

| Metric | Value | Description |

|---|---|---|

| Revenue Growth (Quarterly) | +13.8% | Change in revenue compared to the previous quarter. |

| Earnings Growth (YOY Quarterly) | +59.8% | Change in earnings compared to the same quarter last year. |

| Operating Margin | 9.2% | Income from operations as a percentage of revenue, before taxes and interest. |

| Profit Margin | 4.28% | Net income as a percentage of revenue, after all expenses. |

| Debt-to-Equity (D/E) Ratio | 71.08 | Company’s total debt divided by total shareholder equity. |

| Beta | 0.55 | Beta is less than 1 indicating that the Apollo Hospitals’s price is less volatile than the market. |

Nifty 500 Performance Overview

Get ready for the market scoop! The Nifty 500 kicked off the day at ₹21,052.9. It had its ups and downs, hitting a low of ₹20,972.65 and a high of ₹21,146.25. Finally, it closed at ₹20,987.94, marking a slight dip of -0.03%.

Stay tuned for the top performers and laggards that shaped today’s Nifty 500 movement.

Nifty 500 Top Gainers

| Stock | Close | Range |

|---|---|---|

| Hitachi Energy | ₹9,578.75 (10.53%) | ₹8,695.95 – ₹9890 |

| REC | ₹509.29 (9.99%) | ₹463.2 – ₹511.64 |

| JM Financial | ₹88.9 (9.07%) | ₹82.3 – ₹90.35 |

| Gillette India | ₹6658 (7.26%) | ₹6,340.14 – ₹6859 |

| Kfin Technologies | ₹749.95 (6.27%) | ₹726.2 – ₹765.65 |

Nifty 500 Top Losers

| Stock | Close | Range |

|---|---|---|

| Sun Pharma Advanced Research Company | ₹232.3 (-4.99%) | ₹232.3 – ₹232.3 |

| Motilal Oswal Financial Services | ₹2374 (-4.83%) | ₹2,365.35 – ₹2,509.14 |

| Indian Oil | ₹168.85 (-4.47%) | ₹167.85 – ₹179.8 |

| Rossari Biotech | ₹749.25 (-3.98%) | ₹745 – ₹779 |

| Birlasoft | ₹650.25 (-3.63%) | ₹649.09 – ₹690.15 |

Nifty 51 to 500 Stocks To Watch for Tomorrow

➲ Ashok Leyland (Bullish Pattern)

- Performance Overview: In the last 23 trading sessions, Ashok Leyland has closed in green 16 times and in red 7 times.

- Recent Trend: Ashok Leyland has been on a 7-day green streak, with daily closes above the opening price since Fri 19 Apr 2024

- Returns: Ashok Leyland gave a 15.15% returns in the last 23 trading sessions, meaning an investment of ₹10,000 would have grown to ₹11,515

- Financial Insight: Ashok Leyland reported a net profit of ₹608.85 Crore in the 2023-Q3 Income Statement.

- As of Tue 30 Apr 2024, Ashok Leyland has a Market Capital of ₹54,351.33 Crore.

- Summary: Ashok Leyland exhibits a strong bullish pattern. Investors should monitor its price movements and consider it for both short-term and long-term growth prospects. Checkout Ashok Leyland Target for Tomorrow and Ashok Leyland Targets for 2024 & 2025.

Ashok Leyland Financial Performance

| Metric | Value | Description |

|---|---|---|

| Revenue Growth (Quarterly) | +6.7% | Change in revenue compared to the previous quarter. |

| Earnings Growth (YOY Quarterly) | +75.59% | Change in earnings compared to the same quarter last year. |

| Operating Margin | 15.5% | Income from operations as a percentage of revenue, before taxes and interest. |

| Profit Margin | 5.24% | Net income as a percentage of revenue, after all expenses. |

| Debt-to-Equity (D/E) Ratio | 306.52 | Company’s total debt divided by total shareholder equity. |

| Beta | 0.86 | Beta is less than 1 indicating that the Ashok Leyland’s price is less volatile than the market. |

➲ Aster Healthcare (Bearish Pattern)

- Performance Overview: In the past 23 trading sessions, Aster Healthcare has closed in red 14 times and in green 9 times.

- Recent Trend: Aster Healthcare has been on a 7-day red streak, continuously closing below the opening price since Thu 18 Apr 2024

- Returns: Aster Healthcare gave a -21.47% returns in the last 23 trading sessions, meaning an investment of ₹10,000 would have dropped to ₹7,853

- Financial Insight: Aster Healthcare reported a net profit of 209.22 Crore in the 2023-Q3 Income Statement.

- As of Tue 30 Apr 2024, Ashok Leyland has a Market Capital of ₹17,865.74 Crore.

- Summary: Aster Healthcare is currently in a bearish phase. Investors should closely monitor its price movements, especially Aster Healthcare Target for Tomorrow and Aster Healthcare Targets for 2024 & 2025.

Aster Healthcare Financial Performance

| Metric | Value | Description |

|---|---|---|

| Revenue Growth (Quarterly) | +16.2% | Change in revenue compared to the previous quarter. |

| Earnings Growth (YOY Quarterly) | +28.6% | Change in earnings compared to the same quarter last year. |

| Operating Margin | 8.96% | Income from operations as a percentage of revenue, before taxes and interest. |

| Profit Margin | 2.4% | Net income as a percentage of revenue, after all expenses. |

| Debt-to-Equity (D/E) Ratio | 124.67 | Company’s total debt divided by total shareholder equity. |

| Beta | 0.6 | Beta is less than 1 indicating that the Aster Healthcare’s price is less volatile than the market. |

Top Stocks That Created a New All Time High Today

Top Large Cap Stocks That Created a New All Time High Today

Companies with Market Capital more than 20,000 Crores| Stock | Close | New All-Time High (ATH) | Previous ATH | Previous ATH Date |

|---|---|---|---|---|

| Apar Industries | 7868.00 (+22.35%) | 7980.79 (+1.66%) | 7850.00 | Wed 24 Apr 2024 |

| Ashok Leyland | 192.60 (+7.25%) | 194.20 (+%) | Thu 01 Jan 1970 | |

| Axis Bank | 1163.15 (+3.9%) | 1182.90 (+%) | Thu 01 Jan 1970 | |

| Carborundum | 1426.00 (-18.16%) | 1499.00 (+10.25%) | 1359.59 | Wed 03 Apr 2024 |

| Eicher Motors | 4613.50 (+41.64%) | 4689.95 (+2.58%) | 4571.64 | Wed 24 Apr 2024 |

Top Mid Cap Stocks That Created a New All Time High Today

Companies with Market Capital between 5,000 Crores to 20,000 Crores| Stock | Close | New All-Time High (ATH) | Previous ATH | Previous ATH Date |

|---|---|---|---|---|

| CMS Info Systems | 415.89 (+0.69%) | 434.00 (+%) | Thu 01 Jan 1970 | |

| Concord Biotech | 1654.00 (+3.55%) | 1714.94 (+6.71%) | 1607.00 | Wed 10 Jan 2024 |

| ELANTAS Beck India | 11400.00 (+696.95%) | 11700.00 (+17.11%) | 9990.00 | Mon 01 Apr 2024 |

| Ingersoll Rand | 3994.94 (+66.5%) | 4055.00 (+0.86%) | 4020.10 | Thu 18 Apr 2024 |

| Inox Wind Energy | 7752.54 (+92.25%) | 7999.00 (+9.36%) | 7314.00 | Tue 27 Feb 2024 |

Top Small Cap Stocks That Created a New All Time High Today

Companies with Market Capital less than 5,000 Crores| Stock | Close | New All-Time High (ATH) | Previous ATH | Previous ATH Date |

|---|---|---|---|---|

| Aartech Solonics Ltd | 241.00 (+11.45%) | 241.00 (+%) | Thu 01 Jan 1970 | |

| Aayush Food and Herbs | 256.50 (+4.45%) | 256.80 (+5.96%) | 242.35 | Thu 25 Apr 2024 |

| ABIRAFN | 57.60 (+2.74%) | 57.60 (+15.73%) | 49.77 | Thu 25 Apr 2024 |

| Archidply | 134.00 (-7%) | 142.19 (+%) | Thu 01 Jan 1970 | |

| Auro Laboratories | 231.10 (+17.3%) | 235.30 (+12.2%) | 209.70 | Wed 24 Apr 2024 |