Home / Tue 27 Aug 2024 Market Recap

27 Aug 2024: Nifty 50 Closes at ₹24,996.05 (-0.06%), Bajaj Finserv & Samvardhana Motherson Shine, While Adani Enterprises Shows Bearish Signals

Show Table of Contents

Table of Contents

- 1: Top Indices Performance Overview

- 2: Nifty 50 Performance Overview

- 2.1: Nifty 50 Top Gainers

- 2.2: Nifty 50 Top Losers

- 2.3: Nifty 50 Stocks To Watch for Tomorrow

- 2.3.1: Bajaj Finserv (Bullish Pattern)

- 2.3.2: ➲ Adani Enterprises (Showing Bearish Signs)

- 3: Nifty 500 Performance Overview

- 3.1: Nifty 500 Top Gainers

- 3.2: Nifty 500 Top Losers

- 3.3: Nifty 51 to 500 Stocks To Watch for Tomorrow

- 3.3.1: ➲ Samvardhana Motherson (Bullish Pattern)

- 3.3.2: ➲ Adani Energy (Showing a Bearish Trend)

- 4: Top Stocks That Created a New All Time High Today

- 4.1: Top Large Cap Stocks That Created a New All Time High Today

- 4.2: Top Mid Cap Stocks That Created a New All Time High Today

- 4.3: Top Small Cap Stocks That Created a New All Time High Today

Top Indices Performance Overview

| Stock | Close | Range |

|---|---|---|

| NIFTY 50 | ₹24,996.05 (-0.06%) | ₹24,973.65 – ₹25,073.09 |

| NIFTY BANK | ₹51,171.5 (0.04%) | ₹50,938.1 – ₹51,404.69 |

| NIFTY FIN SERVICE | ₹23,531.94 (0.62%) | ₹23,280.44 – ₹23,603.05 |

| NIFTY IT | ₹41,709.25 (0.11%) | ₹41,589.85 – ₹41,936.69 |

| NIFTY AUTO | ₹25,911.9 (-0.12%) | ₹25,857.05 – ₹26,026.8 |

| NIFTY ENERGY | ₹43,523.69 (-0.62%) | ₹43,483.64 – ₹43,870.55 |

Nifty 50 Performance Overview

The Nifty 50 kicked off the day at ₹25,032.09, taking a roller coaster ride through the session. It dipped to a low of ₹24,973.65 before climbing to a high of ₹25,073.09. Ultimately, it closed at ₹24,996.05, a slight decrease of -0.06% from its starting point.

The day’s ups and downs were influenced by several top gainers and losers, which you can find detailed in the table below.

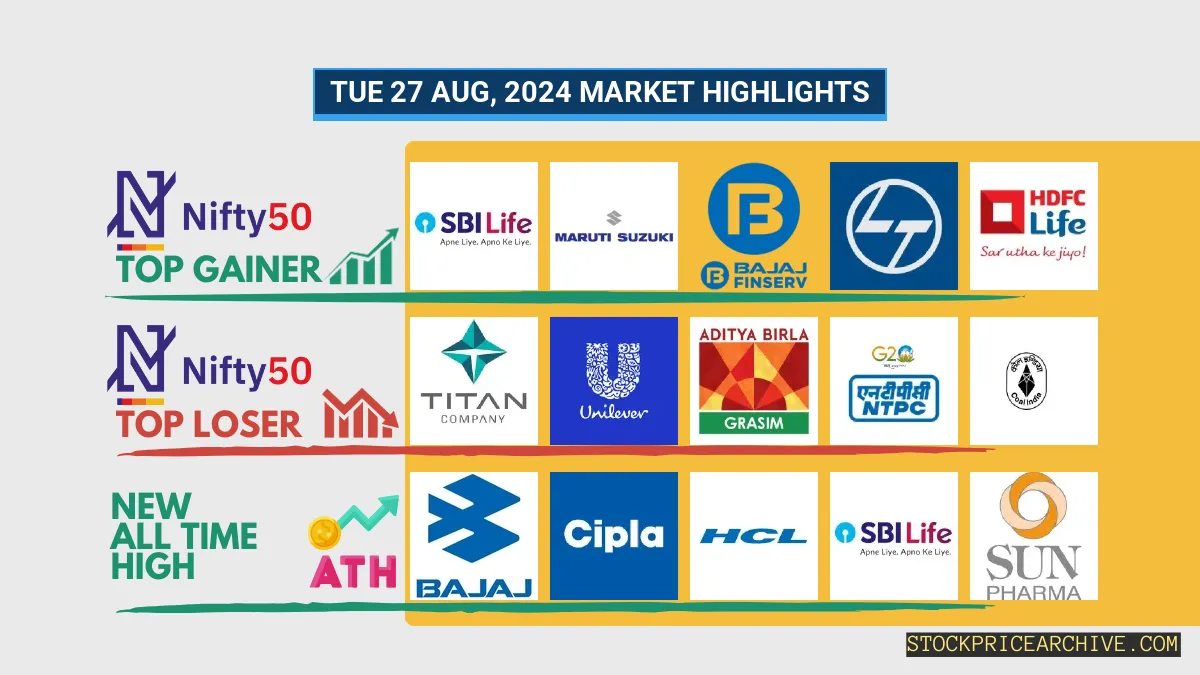

Nifty 50 Top Gainers

| Stock | Close | Range |

|---|---|---|

| SBI Life Insurance | ₹1,835.19 (2.16%) | ₹1,784.09 – ₹1,848.59 |

| Maruti Suzuki | ₹12,496.9 (2.06%) | ₹12,225.09 – ₹12530 |

| Bajaj Finserv | ₹1719 (1.94%) | ₹1652 – ₹1729 |

| Larsen Toubro | ₹3,702.69 (1.66%) | ₹3636 – ₹3737 |

| HDFC Life | ₹737.7 (1.66%) | ₹719.29 – ₹742.45 |

Nifty 50 Top Losers

| Stock | Close | Range |

|---|---|---|

| TITAN | ₹3,551.25 (-2.18%) | ₹3,530.5 – ₹3,658.8 |

| Hindustan Unilever | ₹2767 (-1.92%) | ₹2,759.55 – ₹2,824.1 |

| GRASIM | ₹2,699.89 (-1.35%) | ₹2,697.05 – ₹2,747.94 |

| NTPC | ₹409.64 (-1.26%) | ₹409.1 – ₹416.2 |

| Coal India | ₹531.4 (-1.25%) | ₹530 – ₹541.7 |

Nifty 50 Stocks To Watch for Tomorrow

Bajaj Finserv (Bullish Pattern)

- Performance Overview: Over the last 26 trading days, Bajaj Finserv has seen a positive close on 15 occasions, while it dipped 11 times.

- Recent Trend: Bajaj Finserv has been on an impressive 8-day winning streak, showing strong momentum since Wednesday, August 14, 2024.

- Returns: Your investment in Bajaj Finserv would have grown! Over the past 26 trading days, the stock has delivered a 5.78% return. This means an initial investment of ₹10,000 would be worth ₹10,578 today.

- Financial Insight: Bajaj Finserv has demonstrated strong financial performance. In the last 12 months, the company generated a revenue of ₹1,17,121.19 Crore and a profit of ₹8,342.85 Crore.

- As of Tuesday, August 27, 2024, Bajaj Finserv has a Market Capital of ₹2,61,432.88 Crore.

- Summary: Bajaj Finserv is displaying a strong bullish pattern. Investors are keeping a close eye on its price movements to assess short-term and long-term growth opportunities. To learn more about potential targets, check out Bajaj Finserv Target for Tomorrow and Bajaj Finserv Targets for 2024 & 2025.

Bajaj Finserv Financial Performance

| Metric | Value | Description |

|---|---|---|

| Market Capital | 2,61,432.88 Crore | Market valuation of Bajaj Finserv’s shares. |

| Revenue (TTM) | 1,17,121.19 Crore | Total revenue generated by Bajaj Finserv over the past twelve months. |

| Net Income (TTM) | +8,342.85 Crore | Net Profit or Loss after all the expenses over the past twelve months. |

| Operating Margin | 37.35% | Income from operations as a percentage of revenue, before taxes and interest. |

| Profit Margin | 7.12% | Net income as a percentage of revenue, after all expenses. |

| Revenue Growth (Quarterly) | +34.9% | Change in revenue compared to the previous quarter. |

| Earnings Growth (YOY Quarterly) | +10% | Change in earnings compared to the same quarter last year. |

| Debt-to-Equity (D/E) Ratio | 220.46 | Company’s total debt divided by total shareholder equity. |

| Total Debt | 2,28,783.81 Crore | Sum of Bajaj Finserv’s current & long-term financial obligations. |

| Total Cash | 12,335.01 Crore | Total amount of liquid funds available to Bajaj Finserv. |

| Beta | 1.06 | Beta is greater than 1 indicating that the Bajaj Finserv’s price is more volatile than the market. |

➲ Adani Enterprises (Showing Bearish Signs)

- Performance Overview: In the past 25 trading days, Adani Enterprises has closed lower 15 times and higher 10 times.

- Recent Trend: Adani Enterprises has been on a downward trend for the past four days, with no closing gains since Wednesday, August 21, 2024.

- Returns: Over the last 25 trading days, Adani Enterprises has generated a return of 2.04%. This means that if you had invested ₹10,000 during this period, your investment would have grown to ₹10,204.

- Financial Insight: Over the past 12 months, Bajaj Finserv has generated a revenue of ₹99,248.91 Crore and created a profit of ₹3,887.4 Crore.

- As of Tuesday, August 27, 2024, Bajaj Finserv has a Market Capital of ₹3,50,765.42 Crore.

- Summary: Adani Enterprises is currently showing bearish signals. It’s a good idea to keep a close watch on its performance. You can find potential targets for Adani Enterprises tomorrow on our website at Adani Enterprises Target for Tomorrow and for 2024 and 2025 on Adani Enterprises Targets for 2024 & 2025.

Adani Enterprises Financial Performance

| Metric | Value | Description |

|---|---|---|

| Market Capital | 3,50,765.42 Crore | Market valuation of Adani Enterprises’s shares. |

| Revenue (TTM) | 99,248.91 Crore | Total revenue generated by Adani Enterprises over the past twelve months. |

| Net Income (TTM) | +3,887.4 Crore | Net Profit or Loss after all the expenses over the past twelve months. |

| Operating Margin | 11.12% | Income from operations as a percentage of revenue, before taxes and interest. |

| Profit Margin | 4.05% | Net income as a percentage of revenue, after all expenses. |

| Revenue Growth (Quarterly) | +0.1% | Change in revenue compared to the previous quarter. |

| Earnings Growth (YOY Quarterly) | +115.8% | Change in earnings compared to the same quarter last year. |

| Debt-to-Equity (D/E) Ratio | 147.8 | Company’s total debt divided by total shareholder equity. |

| Total Debt | 65,310.14 Crore | Sum of Adani Enterprises’s current & long-term financial obligations. |

| Total Cash | 4,380.95 Crore | Total amount of liquid funds available to Adani Enterprises. |

| Beta | 0.93 | Beta is less than 1 indicating that the Adani Enterprises’s price is less volatile than the market. |

Nifty 500 Performance Overview

The Nifty 500 kicked off the day at ₹23,592, showing some ups and downs throughout the session. It dipped to a low of ₹23,555.55 before rallying to a high of ₹23,633.19. In the end, it closed at ₹23,604.84, a +0.18% gain for the day.

Nifty 500 Top Gainers

| Stock | Close | Range |

|---|---|---|

| Tata Investment Corporation | ₹7414 (19.99%) | ₹6,178.35 – ₹7414 |

| TATA ELXSI | ₹8,950.09 (16.49%) | ₹7750 – ₹9080 |

| Kfin Technologies | ₹1148 (13.75%) | ₹1,017.04 – ₹1,188.69 |

| Zee Entertainment | ₹151 (11.69%) | ₹134.8 – ₹154.88 |

| CESC | ₹207.89 (10.15%) | ₹187.98 – ₹209.88 |

Nifty 500 Top Losers

| Stock | Close | Range |

|---|---|---|

| Minda Corporation | ₹587.9 (-7.03%) | ₹585.2 – ₹628.84 |

| Suprajit Engineering | ₹545 (-4.62%) | ₹544.45 – ₹560.9 |

| Polyplex Corporation | ₹1,256.05 (-3.89%) | ₹1252 – ₹1,317.3 |

| Syngene International | ₹827.95 (-3%) | ₹823.75 – ₹861.9 |

| Affle | ₹1,652.34 (-2.87%) | ₹1644 – ₹1710 |

Nifty 51 to 500 Stocks To Watch for Tomorrow

➲ Samvardhana Motherson (Bullish Pattern)

- Performance Overview: Samvardhana Motherson has been on a roll lately! In the last 26 trading sessions (from August 1st to August 27th), it closed higher than the previous day 17 times and ended lower 9 times.

- Recent Trend: Get ready for this – Samvardhana Motherson has been on a 9-day green streak, meaning it has closed higher each day since Tuesday, August 13th, 2024!

- Returns: Over those 26 trading sessions, Samvardhana Motherson delivered a solid 3.93% return. This means that if you had invested ₹10,000 on August 1st, it would have grown to ₹10,392.99 by August 27th.

- Financial Insight: Samvardhana Motherson has been doing quite well financially. In the past year, it generated a revenue of a whopping ₹1,04,396.02 Crore, and managed to turn a profit of ₹3,109.49 Crore.

- As of Tuesday, August 27th, 2024, Samvardhana Motherson has a Market Capital of ₹1,33,983.37 Crore.

- Summary: Samvardhana Motherson is showing strong bullish signals, and investors are keeping a close eye on its movements. Are you curious about where it might head next? Checkout Samvardhana Motherson Target for Tomorrow and Samvardhana Motherson Targets for 2024 & 2025.

Samvardhana Motherson Financial Performance

| Metric | Value | Description |

|---|---|---|

| Market Capital | 1,33,983.37 Crore | Market valuation of Samvardhana Motherson’s shares. |

| Revenue (TTM) | 1,04,396.02 Crore | Total revenue generated by Samvardhana Motherson over the past twelve months. |

| Net Income (TTM) | +3,109.49 Crore | Net Profit or Loss after all the expenses over the past twelve months. |

| Operating Margin | 5.99% | Income from operations as a percentage of revenue, before taxes and interest. |

| Profit Margin | 2.97% | Net income as a percentage of revenue, after all expenses. |

| Revenue Growth (Quarterly) | +28% | Change in revenue compared to the previous quarter. |

| Earnings Growth (YOY Quarterly) | +65.5% | Change in earnings compared to the same quarter last year. |

| Debt-to-Equity (D/E) Ratio | 70.6 | Company’s total debt divided by total shareholder equity. |

| Total Debt | 19,921.9 Crore | Sum of Samvardhana Motherson’s current & long-term financial obligations. |

| Total Cash | 7,078 Crore | Total amount of liquid funds available to Samvardhana Motherson. |

| Beta | 1.57 | Beta is greater than 1 indicating that the Samvardhana Motherson’s price is more volatile than the market. |

➲ Adani Energy (Showing a Bearish Trend)

- Performance Snapshot: In the past 25 trading days, Adani Energy has closed higher 13 times and lower 11 times.

- Recent Activity: Adani Energy has been on a downward trend for the last 5 trading days, closing lower each day since Tuesday, August 20, 2024.

- Returns: Over the last 25 trading days, Adani Energy has yielded a 4.09% return. This means if you had invested ₹10,000, your investment would be worth ₹10,409 today.

- Financial Insights: During the past 12 months, Adani Energy has generated a revenue of ₹17,181.76 Crore and a profit of ₹351.85 Crore.

- As of Tuesday, August 27, 2024, Adani Energy has a Market Capitalization of ₹1,30,001.53 Crore.

- In Summary: Adani Energy is currently experiencing a bearish trend. We recommend investors keep a close eye on the stock’s performance, particularly the Adani Energy Target for Tomorrow and the Adani Energy Targets for 2024 & 2025.

Adani Energy Financial Performance

| Metric | Value | Description |

|---|---|---|

| Market Capital | 1,30,001.53 Crore | Market valuation of Adani Energy’s shares. |

| Revenue (TTM) | 17,181.76 Crore | Total revenue generated by Adani Energy over the past twelve months. |

| Net Income (TTM) | -351.85 Crore | Net Profit or Loss after all the expenses over the past twelve months. |

| Operating Margin | 27.74% | Income from operations as a percentage of revenue, before taxes and interest. |

| Profit Margin | -2.05% | Net income as a percentage of revenue, after all expenses. |

| Revenue Growth (Quarterly) | +21.7% | Change in revenue compared to the previous quarter. |

| Earnings Growth (YOY Quarterly) | +46.79% | Change in earnings compared to the same quarter last year. |

| Debt-to-Equity (D/E) Ratio | 270.52 | Company’s total debt divided by total shareholder equity. |

| Total Debt | 37,069.64 Crore | Sum of Adani Energy’s current & long-term financial obligations. |

| Total Cash | 1,920.37 Crore | Total amount of liquid funds available to Adani Energy. |

| Beta | 1.16 | Beta is greater than 1 indicating that the Adani Energy’s price is more volatile than the market. |

Top Stocks That Created a New All Time High Today

Top Large Cap Stocks That Created a New All Time High Today

Companies with Market Capital more than 20,000 Crores| Stock | Close | New All-Time High (ATH) | Previous ATH | Previous ATH Date |

|---|---|---|---|---|

| Alkem Labs | 5891.00 (+1.24%) | 5991.54 (+%) | Thu 01 Jan 1970 | |

| Ashok Leyland | 262.14 (+0.76%) | 264.64 (+%) | Thu 01 Jan 1970 | |

| Aurobindo Pharma | 1551.94 (+0.26%) | 1556.15 (+%) | Thu 01 Jan 1970 | |

| Bajaj Auto | 10501.59 (+0.66%) | 10568.45 (+%) | Thu 01 Jan 1970 | |

| Castrol | 274.85 (+4.34%) | 284.39 (+%) | Thu 01 Jan 1970 |

Top Mid Cap Stocks That Created a New All Time High Today

Companies with Market Capital between 5,000 Crores to 20,000 Crores| Stock | Close | New All-Time High (ATH) | Previous ATH | Previous ATH Date |

|---|---|---|---|---|

| Akzo Nobel India | 3444.75 (+6.39%) | 3464.00 (+%) | Thu 01 Jan 1970 | |

| ASK Automotive | 442.89 (+1.29%) | 450.00 (+%) | Thu 01 Jan 1970 | |

| BECTORFOOD | 1566.59 (-2.06%) | 1632.00 (+%) | Thu 01 Jan 1970 | |

| Bengal & Assam Company | 10263.79 (-1.1%) | 11498.90 (+%) | Thu 01 Jan 1970 | |

| Electrosteel Castings | 223.63 (+2.9%) | 226.22 (+9.81%) | 206.00 | Mon 22 Apr 2024 |

Top Small Cap Stocks That Created a New All Time High Today

Companies with Market Capital less than 5,000 Crores| Stock | Close | New All-Time High (ATH) | Previous ATH | Previous ATH Date |

|---|---|---|---|---|

| 21ST CENTURY MANAG | 113.76 (+1.99%) | 113.76 (+%) | Thu 01 Jan 1970 | |

| Ahmedabad Steelcraft | 224.00 (+0.87%) | 226.45 (+%) | Thu 01 Jan 1970 | |

| Associated Alcohols | 922.70 (-0.53%) | 941.95 (+%) | Thu 01 Jan 1970 | |

| Asian Energy | 433.45 (+2.47%) | 444.14 (+%) | Thu 01 Jan 1970 | |

| Asia Pack | 64.00 (+3.55%) | 64.00 (+%) | Thu 01 Jan 1970 |