Home / Fri 31 May 2024 Market Recap

31 May 2024: Nifty Closes at ₹22,530.69 (+0.18%), HDFC Bank Shows Bullish Pattern, ONGC on a Red Streak!

Show Table of Contents

Table of Contents

- 1: Top Indices Performance Overview

- 2: Nifty 50 Performance Overview

- 2.1: Nifty 50 Top Gainers

- 2.2: Nifty 50 Top Losers

- 2.3: Nifty 50 Stocks To Watch for Tomorrow

- 2.3.1: ➲ HDFC BANK (Bullish Pattern)

- 2.3.2: ➲ ONGC (Bearish Pattern)

- 3: Nifty 500 Performance Overview

- 3.1: Nifty 500 Top Gainers

- 3.2: Nifty 500 Top Losers

- 3.3: Nifty 51 to 500 Stocks To Watch for Tomorrow

- 3.3.1: ➲ Eris Lifesciences

- 3.3.2: ➲ Prince Pipes and Fittings (Bearish Pattern)

- 4: Top Stocks That Created a New All Time High Today

- 4.1: Top Large Cap Stocks That Created a New All Time High Today

- 4.2: Top Mid Cap Stocks That Created a New All Time High Today

- 4.3: Top Small Cap Stocks That Created a New All Time High Today

Top Indices Performance Overview

| Stock | Close | Range |

|---|---|---|

| NIFTY 50 | ₹22,530.69 (0.18%) | ₹22,465.09 – ₹22,653.75 |

| NIFTY BANK | ₹48,983.94 (0.61%) | ₹48,569.05 – ₹49,122.55 |

| NIFTY FIN SERVICE | ₹21,718.3 (0.56%) | ₹21,565.75 – ₹21,786.8 |

| NIFTY IT | ₹32394 (-1.26%) | ₹32,294.15 – ₹32,814.44 |

| NIFTY AUTO | ₹23,461.8 (-0.04%) | ₹23,314.69 – ₹23,725.94 |

| NIFTY ENERGY | ₹40,283.25 (0.74%) | ₹39,923.89 – ₹40,474.94 |

Nifty 50 Performance Overview

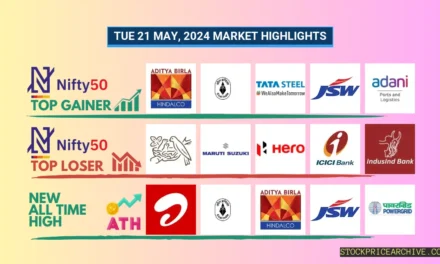

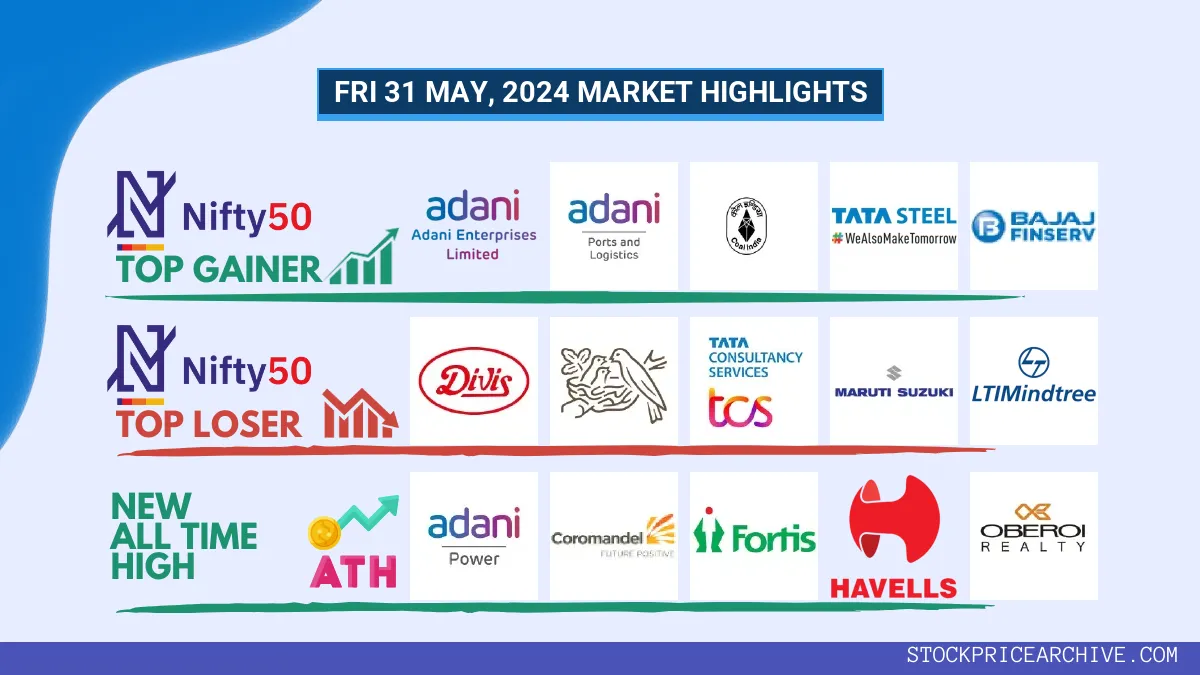

The Nifty 50 started the day at ₹22,568.09. It fluctuated throughout the session, hitting a low of ₹22,465.09 and a high of ₹22,653.75, before finally settling at a close of ₹22,530.69 (+0.18%).Nifty 50 Top Gainers

| Stock | Close | Range |

|---|---|---|

| Adani Enterprises | ₹3414 (6.87%) | ₹3,194.25 – ₹3,433.5 |

| Adani Ports | ₹1439 (4.01%) | ₹1,383.5 – ₹1451 |

| Coal India | ₹491.29 (1.89%) | ₹479.1 – ₹492.95 |

| Tata Steel | ₹167.2 (1.86%) | ₹164 – ₹167.95 |

| Bajaj Finance | ₹6,732.5 (1.75%) | ₹6,616.45 – ₹6770 |

Nifty 50 Top Losers

| Stock | Close | Range |

|---|---|---|

| Divis Lab | ₹4,307.2 (-2.4%) | ₹4,290.14 – ₹4,455.85 |

| Nestle India | ₹2,354.89 (-2.08%) | ₹2345 – ₹2,425.6 |

| TCS | ₹3,670.94 (-1.75%) | ₹3,653.75 – ₹3,749.8 |

| Maruti Suzuki | ₹12,399.29 (-1.58%) | ₹12330 – ₹12,633.34 |

| LTIMindtree | ₹4,701.89 (-1.5%) | ₹4680 – ₹4,775.64 |

Nifty 50 Stocks To Watch for Tomorrow

➲ HDFC BANK (Bullish Pattern)

- Performance Overview: In the past 26 trading sessions, HDFC BANK has closed in green 16 times and closed in red 10 times.

- Recent Trend: HDFC BANK has been on a 2-day green streak, without a single day closing in red since Wed 29 May 2024.

- Returns: HDFC BANK gave a 1.37% returns in the last 26 trading sessions, that means your investment of ₹10,000 would have become ₹10,137

- Financial Insight: Over the past 12 months, HDFC BANK has generated a revenue of ₹2,28,837.94 Crore and created a profit of ₹64,062.04 Crore.

- As of Fri 31 May 2024, HDFC BANK has a Market Capital of ₹11,53,545.37 Crore.

- Summary: HDFC BANK exhibits a robust bullish pattern. Investors should monitor its price movements targets for both short-term and long-term growth prospects: Checkout HDFC BANK Target for Tomorrow and HDFC BANK Targets for 2024 & 2025.

HDFC BANK Financial Performance

| Metric | Value | Description |

|---|---|---|

| Market Capital | 11,53,545.37 Crore | Market valuation of HDFC BANK’s shares. |

| Revenue (TTM) | 2,28,837.94 Crore | Total revenue generated by HDFC BANK over the past twelve months. |

| Net Income (TTM) | +64,062.04 Crore | Net Profit or Loss after all the expenses over the past twelve months. |

| Operating Margin | 26.55% | Income from operations as a percentage of revenue, before taxes and interest. |

| Profit Margin | 27.99% | Net income as a percentage of revenue, after all expenses. |

| Revenue Growth (Quarterly) | +113.19% | Change in revenue compared to the previous quarter. |

| Earnings Growth (YOY Quarterly) | +39.9% | Change in earnings compared to the same quarter last year. |

| Debt-to-Equity (D/E) Ratio | 1.62 | Company’s total debt divided by total shareholder equity. |

| Total Debt | 7,30,615.46 Crore | Sum of HDFC BANK’s current & long-term financial obligations. |

| Total Cash | 2,28,834.51 Crore | Total amount of liquid funds available to HDFC BANK. |

| Beta | 0.76 | Beta is less than 1 indicating that the HDFC BANK’s price is less volatile than the market. |

➲ ONGC (Bearish Pattern)

- Performance Overview: In the last 26 trading sessions, ONGC has closed in red 15 times and in green 11 times.

- Recent Trend: ONGC has been on a 6-day red streak, without a single day closing in green since Thu 23 May 2024.

- Returns: ONGC gave a negative return of -5.37% in the last 26 trading sessions, meaning an initial investment of ₹10,000 would have decreased to ₹9,463.

- Financial Insight: Over the past 12 months, ONGC has generated a revenue of ₹6,43,037.02 Crore and created a profit of ₹49,221.37 Crore.

- As of Fri 31 May 2024, ONGC has a Market Capital of ₹3,56,336.97 Crore.

- Summary: ONGC is currently experiencing a bearish trend. Consider monitoring the stock closely, especially its Target for Tomorrow and Targets for 2024 & 2025.

ONGC Financial Performance

| Metric | Value | Description |

|---|---|---|

| Market Capital | 3,56,336.97 Crore | Market valuation of ONGC’s shares. |

| Revenue (TTM) | 6,43,037.02 Crore | Total revenue generated by ONGC over the past twelve months. |

| Net Income (TTM) | +49,221.37 Crore | Net Profit or Loss after all the expenses over the past twelve months. |

| Operating Margin | 9.21% | Income from operations as a percentage of revenue, before taxes and interest. |

| Profit Margin | 7.65% | Net income as a percentage of revenue, after all expenses. |

| Revenue Growth (Quarterly) | +49.5% | Change in revenue compared to the previous quarter. |

| Earnings Growth (YOY Quarterly) | +172% | Change in earnings compared to the same quarter last year. |

| Debt-to-Equity (D/E) Ratio | 41.95 | Company’s total debt divided by total shareholder equity. |

| Total Debt | 1,53,180.53 Crore | Sum of ONGC’s current & long-term financial obligations. |

| Total Cash | 42,069.84 Crore | Total amount of liquid funds available to ONGC. |

| Beta | 0.7 | Beta is less than 1 indicating that the ONGC’s price is less volatile than the market. |

Nifty 500 Performance Overview

The Nifty 500 opened the day at ₹21,131.44 and closed at ₹21,124.4, marking a +0.4% change from yesterday.

During the session, the index fluctuated, reaching a high of ₹21,176.4 and a low of ₹21,003.5.

Nifty 500 Top Gainers

| Stock | Close | Range |

|---|---|---|

| Jindal Stainless | ₹793.5 (12.13%) | ₹716.04 – ₹837 |

| zfcvindia | ₹17,410.9 (9.41%) | ₹15514 – ₹17900 |

| Adani Gas | ₹1,044.55 (9.35%) | ₹955.2 – ₹1060 |

| NLC India | ₹236.5 (8.38%) | ₹215.55 – ₹240 |

| Adani Power | ₹756.5 (8.31%) | ₹704.95 – ₹796.59 |

Nifty 500 Top Losers

| Stock | Close | Range |

|---|---|---|

| Welspun Corp | ₹548.95 (-8.75%) | ₹545 – ₹585 |

| Ipca Labs | ₹1,152.15 (-7.79%) | ₹1,146.58 – ₹1,239.9 |

| FDC | ₹432.5 (-5.77%) | ₹429.2 – ₹463.35 |

| Page Industries | ₹35,954.69 (-5.3%) | ₹35,731.05 – ₹37,578.64 |

| Swan Energy | ₹574.75 (-5%) | ₹574.75 – ₹574.75 |

Nifty 51 to 500 Stocks To Watch for Tomorrow

➲ Eris Lifesciences

- Performance Overview: In the last 26 trading sessions, Eris Lifesciences has closed in green 17 times and in red 9 times.

- Recent Trend: Eris Lifesciences has been on a five-day green streak, without a single day closing in red since Friday, May 24, 2024.

- Returns: Eris Lifesciences gave a 4.99% returns in the last 26 trading sessions, that means your investment of ₹10,000 would have become ₹10,499.

- Financial Insight: Over the past 12 months, Eris Lifesciences has generated a renvenue of ₹1,840.62 Crore and created a profit of ₹386.43 Crore.

- As of Friday, May 31, 2024, Eris Lifesciences has a Market Capital of ₹11,941.52 Crore.

- Summary: Eris Lifesciences exhibits a robust bullish pattern. A bullish pattern indicates that the price of Eris Lifesciences is expected to rise in the future. Investors should monitor its price movements targets for both short-term and long-term growth prospects: Checkout Eris Lifesciences Target for Tomorrow and Eris Lifesciences Targets for 2024 & 2025.

Eris Lifesciences Financial Performance

| Metric | Value | Description |

|---|---|---|

| Market Capital | 11,941.52 Crore | Market valuation of Eris Lifesciences’s shares. |

| Revenue (TTM) | 1,840.62 Crore | Total revenue generated by Eris Lifesciences over the past twelve months. |

| Net Income (TTM) | +386.43 Crore | Net Profit or Loss after all the expenses over the past twelve months. |

| Operating Margin | 26.84% | Income from operations as a percentage of revenue, before taxes and interest. |

| Profit Margin | 20.99% | Net income as a percentage of revenue, after all expenses. |

| Revenue Growth (Quarterly) | +15.7% | Change in revenue compared to the previous quarter. |

| Earnings Growth (YOY Quarterly) | +0.89% | Change in earnings compared to the same quarter last year. |

| Debt-to-Equity (D/E) Ratio | 34.17 | Company’s total debt divided by total shareholder equity. |

| Total Debt | 829.5 Crore | Sum of Eris Lifesciences’s current & long-term financial obligations. |

| Total Cash | 190.62 Crore | Total amount of liquid funds available to Eris Lifesciences. |

| Beta | 0.41 | Beta is less than 1 indicating that the Eris Lifesciences’s price is less volatile than the market. |

➲ Prince Pipes and Fittings (Bearish Pattern)

- Performance Overview: In the past 26 trading sessions, Prince Pipes and Fittings has closed in red 16 times and in green 10 times

- Recent Trend: Prince Pipes and Fittings has been on a 10-day red streak, without a single day closing in green since Friday, May 17, 2024.

- Returns: Prince Pipes and Fittings gave a -2.91% returns in the last 26 trading sessions, that means your investment of ₹10,000 would have become ₹9,709

- Financial Insight: Over the past 12 months, Prince Pipes and Fittings has generated a revenue of ₹2,593.02 Crore and created a profit of ₹221.96 Crore.

- As of Friday, May 31, 2024, Prince Pipes and Fittings has a Market Capital of ₹6,972.52 Crore.

- Summary: Prince Pipes and Fittings is currently experiencing a bearish phase. We advise investors to keep a close watch, especially on Prince Pipes and Fittings Target for Tomorrow and Prince Pipes and Fittings Targets for 2024 & 2025.

Prince Pipes and Fittings Financial Performance

| Metric | Value | Description |

|---|---|---|

| Market Capital | 6,972.52 Crore | Market valuation of Prince Pipes and Fittings’s shares. |

| Revenue (TTM) | 2,593.02 Crore | Total revenue generated by Prince Pipes and Fittings over the past twelve months. |

| Net Income (TTM) | +221.96 Crore | Net Profit or Loss after all the expenses over the past twelve months. |

| Operating Margin | 8.52% | Income from operations as a percentage of revenue, before taxes and interest. |

| Profit Margin | 8.55% | Net income as a percentage of revenue, after all expenses. |

| Revenue Growth (Quarterly) | -12.4% | Change in revenue compared to the previous quarter. |

| Earnings Growth (YOY Quarterly) | +6.3% | Change in earnings compared to the same quarter last year. |

| Debt-to-Equity (D/E) Ratio | 4.07 | Company’s total debt divided by total shareholder equity. |

| Total Debt | 58.96 Crore | Sum of Prince Pipes and Fittings’s current & long-term financial obligations. |

| Total Cash | 231.83 Crore | Total amount of liquid funds available to Prince Pipes and Fittings. |

| Beta | 0.92 | Beta is less than 1 indicating that the Prince Pipes and Fittings’s price is less volatile than the market. |

Top Stocks That Created a New All Time High Today

Top Large Cap Stocks That Created a New All Time High Today

Companies with Market Capital more than 20,000 Crores| Stock | Close | New All-Time High (ATH) | Previous ATH | Previous ATH Date |

|---|---|---|---|---|

| Adani Power | 756.50 (+8.31%) | 796.59 (+23.15%) | 646.84 | Thu 04 Apr 2024 |

| Bharti Hexacom | 1025.00 (+1.43%) | 1053.94 (+%) | Thu 01 Jan 1970 | |

| Blue Star | 1598.80 (+6.56%) | 1648.69 (+%) | Thu 01 Jan 1970 | |

| CEBBCO | 603.95 (+5.98%) | 613.04 (+41.31%) | 433.80 | Mon 01 Jan 2024 |

| Coromandel International | 1305.00 (-0.24%) | 1313.09 (+%) | Thu 01 Jan 1970 |

Top Mid Cap Stocks That Created a New All Time High Today

Companies with Market Capital between 5,000 Crores to 20,000 Crores| Stock | Close | New All-Time High (ATH) | Previous ATH | Previous ATH Date |

|---|---|---|---|---|

| J. Kumar Infraprojects | 755.75 (+13.91%) | 764.29 (+%) | Thu 01 Jan 1970 | |

| NCC | 286.95 (+0.45%) | 297.70 (+11.33%) | 267.40 | Tue 27 Feb 2024 |

| TECHNOE | 1418.34 (+17.32%) | 1450.65 (+53.34%) | 946.00 | Fri 19 Apr 2024 |

| Titagarh Rail Systems | 1415.69 (+4.24%) | 1450.00 (+%) | Thu 01 Jan 1970 | |

| UCIL | 102.58 (+1.99%) | 102.58 (+%) | Thu 01 Jan 1970 |

Top Small Cap Stocks That Created a New All Time High Today

Companies with Market Capital less than 5,000 Crores| Stock | Close | New All-Time High (ATH) | Previous ATH | Previous ATH Date |

|---|---|---|---|---|

| Ace Software Exports | 209.10 (+2%) | 209.10 (+39.14%) | 150.28 | Mon 01 Apr 2024 |

| ADC India Communications | 1400.00 (+12.11%) | 1414.00 (+%) | Thu 01 Jan 1970 | |

| Ahmedabad Steelcraft | 70.95 (+1.99%) | 70.95 (+%) | Thu 01 Jan 1970 | |

| Bacil Pharma | 26.78 (+4.97%) | 26.78 (+34.64%) | 19.89 | Wed 24 Apr 2024 |

| Conart Engineers | 138.69 (+9.99%) | 138.69 (+%) | Thu 01 Jan 1970 |