Home / Trent Soars From 52 Week Low To Record High Delivering 164 5 Return In 11 Months

Trent Soars from 52-Week Low to Record High, Delivering 164.5% Return in 11 Months!

Show Table of Contents

Table of Contents

- 1: Chart: Trent All Time High & 52 Week Low as of 31 Dec 2023

- 2: Trent Limited’s Record Surge to a New All-Time High

- 2.1: Factors Contributing to a Stock’s All-Time High

- 2.2: Positive Earnings Reports

- 2.3: Favorable Industry Trends

- 2.4: Positive Analyst Ratings

- 2.5: Potential Scenarios Following an All-Time High

- 3: Trent Stock Analysis: Potential Supports and Targets

- 3.1: KEY PERFORMANCE METRICS

- 3.1.1: Trent Fibonacci Retracement Or Support levels

- 3.1.2: Trent Fibonacci Extensions Or Target levels

- 4: Making Informed Investment Decisions

- 4.1: Company’s Financial Health

- 4.2: Industry Outlook

- 4.3: Market Sentiment

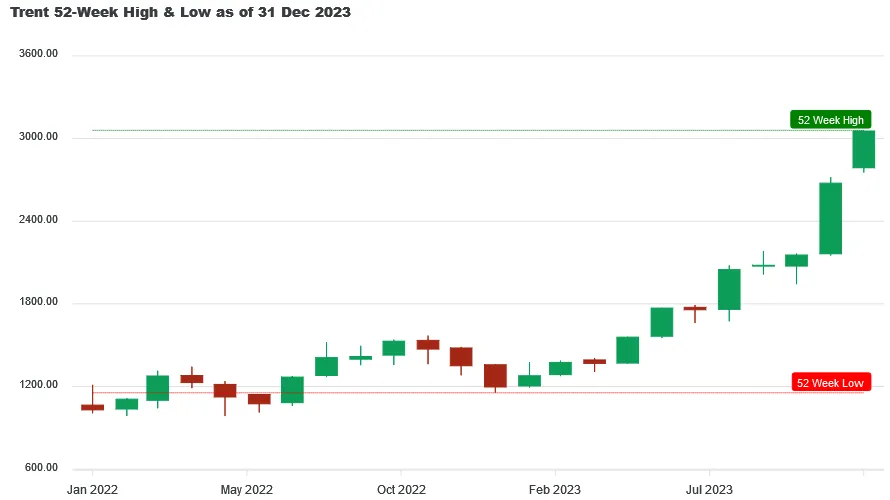

Chart: Trent All Time High & 52 Week Low as of 31 Dec 2023

Trent hit its 52 week low of ₹1155.00 on 27 Jan 2023 and from there it move to ₹3060.35 creating a brand-new All Time High on 29 Dec 2023, giving a whopping 164.50% return in just 11 months and 4 days.

If you had invested ₹10,000 at its 52-week low price, your investment would have grown to ₹26,450 by 31 Dec 2023. This represents a gain of ₹16,450 in just 11 months and 4 days. Given TRENT's strong recent performance, Lets find out what opportunities lies ahead for TRENT

If you had invested ₹10,000 at its 52-week low price, your investment would have grown to ₹26,450 by 31 Dec 2023. This represents a gain of ₹16,450 in just 11 months and 4 days. Given TRENT's strong recent performance, Lets find out what opportunities lies ahead for TRENT

Stay ahead of the market! Get instant alerts on crucial market breakouts. Don't miss out on key opportunities!

Your phone number will be HIDDEN to other users.

Trent Limited’s Record Surge to a New All-Time High

The all-time high of Trent Limited can be a result of many factors. Its previous all-time high was made on 27 December 2023 at ₹ 3059.7. It took 02 days to create a new all-time high at ₹ 3060.35 on 29 December 2023. In between, it made a low of ₹ 3003 on 28 December 2023, implying a correction of over 1.85%. It may signal a shift in the investors’ sentiment due to the company’s financial upturn or may represent overvaluation. Let’s examine the key drivers for its all-time high.

Factors Contributing to a Stock’s All-Time High

Positive Earnings Reports

- In Q2 FY24, its revenue increased by 52.73% quarter-on-quarter. It earned a revenue of ₹ 2982 crores. In the last 7 quarters, it has consistently increased its revenue by over 40% YOY.

- In Q2 FY24, its operating income increased by 34.51% quarter-on-quarter due to comparatively lower cost of goods sold and operating expenses. It earned an operating income of ₹ 304 crores.

- Compared to the data of the last five years since 2018, it earned the highest net margin of 5.40% in 2022. It earned a net income of ₹ 445 crores for FY23.

Favorable Industry Trends

- The time frame of particular styles of clothes remaining in fashion is reducing at a significant speed. It has given rise to a new segment known as fast fashion, where customers are focussing not only on the design but also on the affordability of the products. Trent, through Zudio outlets, can provide trendy apparel at an affordable price, thus benefiting from the trend.

- The population below the age of 35 years is almost 66% of the total population of India. The age segment is giving preference to branded products for quality and status but, at the same time, doesn’t want to commit to a single product for a long time. Trent can market itself according to the expectations of the majority of its customers to boost its presence further.

- The surge in online shopping has opened a new segment of revenue for companies. Trent still needs to foray into the online segment but can consider entering it to boost its revenue further. It just needs to convert its offline presence into an online presence when it considers it the right time to do so.

Positive Analyst Ratings

Motilal Oswal Financial Services has given a “buy” rating to Trent Limited with a target price of ₹ 3140. Trent’s revenue growth was fuelled by same-store sales growth, footprint addition, and healthy scale-up opportunities, which offer substantial growth prospects over the next 3 to 5 years. The company’s grocery segment, Star, also provides a tremendous opportunity considering the good revenue provided through the measly presence of 65 stores. The company’s shares are expected to provide greater than 15% returns over 12 months.

Potential Scenarios Following an All-Time High

Converting numbers and candles into information can provide us with the market’s stance on the stock, which may help us make correct investment decisions. Since the listing of Trent Limited in January 2003, it has converted an investment of ₹ 15.93 into ₹ 3060.35, which means it gave 192x returns in almost 21 years. In February 2023, it started its bull rally with higher highs and higher lows every month, except in October 2023. We can expect the trends to continue so the investors may enter the stock at the price of their liking but keep the stop loss at the low made in the previous month.

Trent Stock Analysis: Potential Supports and Targets

Fri 29 Dec 2023 - In a remarkable market development, Trent has soared to ₹3060.35, setting a brand-new All Time High record! With this surge, there are chances of it becoming volatile, as many investors may like to book their profits by exiting or closing their positions. At this time potential investors and current stakeholders should keep an eye for opportunities for entry or exit.

Below you will find Trent's metrics highlight, potential support and targets derived using Fibonacci Retracement and Extensions method, where Golden Ratio is assumed to be a good support (entry point) and Golden Extension to be good resistance (target point)

KEY PERFORMANCE METRICS

| Metrics | Value | Occured On |

|---|---|---|

| Close Price | ₹3054.95 | Sun, 31 Dec 2023 |

| 52 Week High | ₹3060.35 | Fri, 29 Dec 2023 |

| 52 Week Low | ₹1155.00 | Fri, 27 Jan 2023 |

| All Time High | ₹3060.35 | Fri 29 Dec 2023 |

The above table shows that the close price of Trent on Sun, 31 Dec 2023 was ₹3054.95. Notably, the All-Time High is same as the 52-Week High, indicating that the all-time high was achieved recently and it cloud be a strong resistance level which would need great upward momentum to break.

It's possible that some investors might consider booking profits near the 3060.35 mark, which could apply downward pressure on the stock price.

But what does this newly created milestone signify for potential investors? Lets find out.

Trent Fibonacci Retracement Or Support levels

For those considering an entry, the Golden Ratio (61.8%) retracement level of ₹1882 offers a promising point, given the likelihood of a pullback from these levels as new investors might come in at these levels.

| Retracement or Support Levels | Values | |

|---|---|---|

| S1 | 23.6% | ₹2610 |

| S2 | 38.2% | ₹2332 |

| S3 | 50.0% | ₹2107 |

| S4 | 61.8% (Golden Ratio) | ₹1882 |

| S5 | 78.6% | ₹1562 |

| S6 | 52 Week Low | ₹1155 |

Note: This table was last updated on Sun, 31 Dec 2023.

Trent Fibonacci Extensions Or Target levels

For those considering an exit, the Golden Extension (161.8%) level of ₹4237 offers a promising point, given the likelihood of a downward momentum from these levels as investors might start booking their profits at these levels.

| Extensions or Target Levels | Values | |

|---|---|---|

| T1 | 52 Week High | ₹3060 |

| T2 | 138.2% | ₹3788 |

| T3 | 161.8% (Golden Extension) | ₹4237 |

| T4 | 200% | ₹4965 |

| T5 | 261.8% | ₹6143 |

Note: This table was last updated on Sun, 31 Dec 2023.

Also read: Trent Share Price Target From 2025 to 2039

Making Informed Investment Decisions

For any stock, reaching an all-time high is a significant milestone. Still, conducting thorough research and considering various factors is essential before making investment decisions. To make informed choices that align with your investment goals and risk tolerance, one needs to analyze the company’s fundamentals, industry trends, management’s strategy, and overall market conditions.

Company’s Financial Health

- In 2022, Trent had a debt of ₹ 4464 crores with a negative free cash flow of ₹ 111 crores and cash & equivalents of ₹ 84.49 crores. It shows a huge difference between the debt and funds, which makes it essential for the company to increase the amount under free cash flow or cash & equivalents.

- In the short term, it has a liability of ₹ 1094 crores covered by assets of ₹ 2378 crores. The assets of ₹ 6603 crores cover its long-term liabilities of ₹ 5224 crores. Considering the way its debt has increased since 2018, it may need to reduce its dividend payout ratio or sell a few of its assets.

Industry Outlook

- India’s growing economy is giving rise to a middle class that can afford higher consumer spending. The trend is favourable to retailers as it increases the customer base for their fashion and lifestyle products. It will also create ideal conditions where the products can be priced at a higher cost without losing on sales in terms of the number of products sold.

- In a few years, the retail penetration in metro cities will reach saturation, which will make the retailers expand in Tier 2 and 3 cities for further growth. A few of the brands can also expand internationally to market themselves in other countries where Indian brands are considered luxury brands.

Market Sentiment

Trent Limited has reached a new all-time high of ₹ 3060.35 due to continuous positive growth trends in revenue and profits. The investors’ sentiment about the company’s prospects, boosted by favourable industry trends, also contributed to the surge in Trent’s share price. Motilal Oswal’s “buy” rating can be considered as a positive signal; however, its high debt level requires careful financial management. The overall market sentiment remains optimistic, with prospects for further growth in urban markets. Investors need to conduct detailed research, considering factors like company fundamentals, industry trends, and financial health, to make informed investment decisions.