Home / Aurobindo Pharma Jumps To All Time High 174 Up In 10 Months

Aurobindo Pharma jumps to All-Time High: 174% up in 10+ Months!

Show Table of Contents

Table of Contents

- 1: Chart: Aurobindo Pharma All Time High & 52 Week Low as of 21 Dec 2023

- 2: Aurobindo Pharma’s Record Surge to a New All-Time High

- 2.1: Factors Contributing to a Stock’s All-Time High

- 2.2: Positive Earnings Reports

- 2.3: Favorable Industry Trends

- 2.4: Positive Analyst Ratings

- 2.5: Potential Scenarios Following an All-Time High

- 3: Aurobindo Pharma Stock Analysis: Potential Supports and Targets

- 3.1: KEY PERFORMANCE METRICS

- 3.1.1: Aurobindo Pharma Fibonacci Retracement Or Support levels

- 3.1.2: Aurobindo Pharma Fibonacci Extensions Or Target levels

- 4: Making Informed Investment Decisions

- 4.1: Company’s Financial Health

- 4.2: Industry Outlook

- 4.3: Market Sentiment

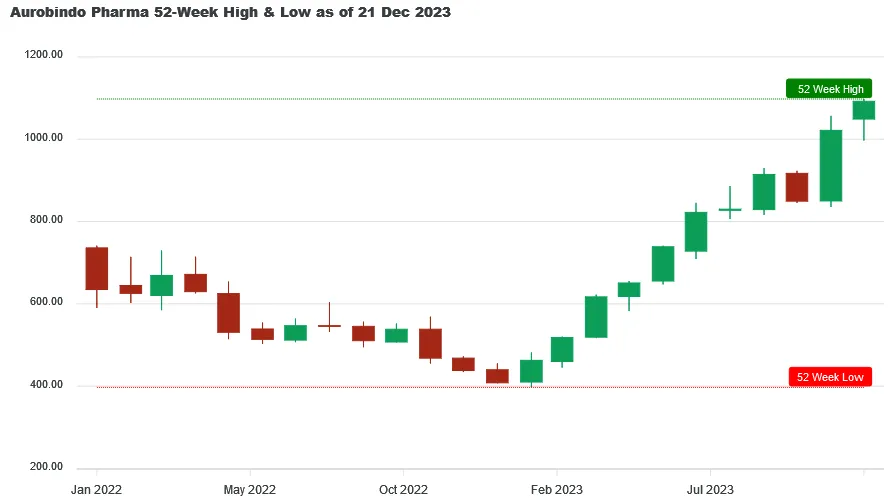

Chart: Aurobindo Pharma All Time High & 52 Week Low as of 21 Dec 2023

Aurobindo Pharma hit its 52 week low of ₹397.20 on 03 Feb 2023 and from there it move to ₹1097.80 creating a brand-new All Time High on 21 Dec 2023, giving a whopping 174.96% return in just 10 months and 18 days.

If you had invested ₹10,000 at its 52-week low price, your investment would have grown to ₹27,496 by 21 Dec 2023. This represents a gain of ₹17,496 in just 10 months and 18 days. Given AUROPHARMA's strong recent performance, Lets find out what opportunities lies ahead for AUROPHARMA

If you had invested ₹10,000 at its 52-week low price, your investment would have grown to ₹27,496 by 21 Dec 2023. This represents a gain of ₹17,496 in just 10 months and 18 days. Given AUROPHARMA's strong recent performance, Lets find out what opportunities lies ahead for AUROPHARMA

Stay ahead of the market! Get instant alerts on crucial market breakouts. Don't miss out on key opportunities!

Your phone number will be HIDDEN to other users.

Aurobindo Pharma’s Record Surge to a New All-Time High

The all-time high of Aurobindo Pharma can be a result of many factors. Its previous all-time high was made on 11 May 2023 at ₹ 1063.9. It took 2 years, 7 months, and 10 days to create a new all-time high at ₹ 1097.8 on 21 December 2023. In between, it made a low of ₹ 411.8 on 03 February 2023, implying a correction of over 61%. It may represent a change in the investors’ sentiment about the company due to improved financial condition or may represent overvaluation. Let’s go through the factors contributing to its all-time high.

Factors Contributing to a Stock’s All-Time High

Positive Earnings Reports

- In Q2 FY24, Auro Pharma’s revenue increased by 25.79 % year-on-year, reaching ₹ 7219 crores.

- Out of the last 6 quarters, its revenue has increased twice YOY in Q1 FY24 and Q2 FY24. Its revenue increased by 84.93% YOY in Q2 FY24 and reached ₹ 757 crores.

- It made a financially prudent decision to reduce the payout ratio on account of increasing debt and reducing free cash flow. It shows the company’s commitment to keeping its financial health first rather than attracting investors. Such companies can easily handle economically challenging situations.

Favorable Industry Trends

- Specific drug markets have always experienced growth due to a lesser number of manufacturers. Aurobindo Pharma also has a few special drugs, such as dementia drugs. Dementia, which is mostly related to old age, patients are increasing as the life expectancy of people increases, thus increasing the demand for dementia drugs, which Aurobindo Pharma also produces.

- Aurobindo Pharma has already made its name as a pharmaceutical company with many drugs in its portfolio. It has also started to move backwards in the value chain by manufacturing active pharmaceutical ingredients, which are considered raw materials for manufacturing drugs. It will help Aurobindo Pharma to increase its overall profits.

- The generic drug market is continuously increasing due to the expiration of many drug patents. Companies like Aurobindo Pharma, which have already made their name in the generic drug market, can capture a significant portion of it through its network spread over 149+ countries.

Positive Analyst Ratings

According to GEPL Capital, expectations are set for a continued rise in price levels, aiming for a target of Rs 1,201. It is advisable to establish a stop-loss at Rs 1,048 based on the closing values. It is currently trading at its all-time high, and that is also made through a continuous rising trend, which is an indication of a strong momentum.

Potential Scenarios Following an All-Time High

(Based on the chart of 1-month timeframe)

Converting numbers and candles into information can provide us with the market’s stance on the stock, which may help us make correct investment decisions. On considering the data from January 2003 of all-time highs that were formed after a gap of at least a month, a few interesting observations can be made about the way share price behaved after making an all-time high.

- If the volume in the month of making an all-time high is less than the previous month and the candle is green, then it can be considered as a bullish signal. One may buy the stock at the price of liking and keep the stop loss at the low of the all-time high month.

- If the volume in the month of making an all-time high is higher and the candle is green, one should observe the stock for one more month. If, in the subsequent month, the candle is green and has created a higher high and higher low, then one may buy the stock with a stop loss set at the low of the subsequent month.

Aurobindo Pharma Stock Analysis: Potential Supports and Targets

Thu 21 Dec 2023 - In a remarkable market development, Aurobindo Pharma has soared to ₹1097.80, setting a brand-new All Time High record! With this surge, there are chances of it becoming volatile, as many investors may like to book their profits by exiting or closing their positions. At this time potential investors and current stakeholders should keep an eye for opportunities for entry or exit.

Below you will find Aurobindo Pharma's metrics highlight, potential support and targets derived using Fibonacci Retracement and Extensions method, where Golden Ratio is assumed to be a good support (entry point) and Golden Extension to be good resistance (target point)

KEY PERFORMANCE METRICS

| Metrics | Value | Occured On |

|---|---|---|

| Close Price | ₹1092.15 | Thu, 21 Dec 2023 |

| 52 Week High | ₹1097.80 | Thu, 21 Dec 2023 |

| 52 Week Low | ₹397.20 | Fri, 03 Feb 2023 |

| All Time High | ₹1097.80 | Thu 21 Dec 2023 |

The above table shows that the close price of Aurobindo Pharma on Thu, 21 Dec 2023 was ₹1092.15. Notably, the All-Time High is same as the 52-Week High, indicating that the all-time high was achieved recently and it cloud be a strong resistance level which would need great upward momentum to break.

It's possible that some investors might consider booking profits near the 1097.80 mark, which could apply downward pressure on the stock price.

But what does this newly created milestone signify for potential investors? Lets find out.

Aurobindo Pharma Fibonacci Retracement Or Support levels

For those considering an entry, the Golden Ratio (61.8%) retracement level of ₹664 offers a promising point, given the likelihood of a pullback from these levels as new investors might come in at these levels.

| Retracement or Support Levels | Values | |

|---|---|---|

| S1 | 23.6% | ₹932 |

| S2 | 38.2% | ₹830 |

| S3 | 50.0% | ₹747 |

| S4 | 61.8% (Golden Ratio) | ₹664 |

| S5 | 78.6% | ₹547 |

| S6 | 52 Week Low | ₹397 |

Note: This table was last updated on Thu, 21 Dec 2023.

Aurobindo Pharma Fibonacci Extensions Or Target levels

For those considering an exit, the Golden Extension (161.8%) level of ₹1530 offers a promising point, given the likelihood of a downward momentum from these levels as investors might start booking their profits at these levels.

| Extensions or Target Levels | Values | |

|---|---|---|

| T1 | 52 Week High | ₹1097 |

| T2 | 138.2% | ₹1365 |

| T3 | 161.8% (Golden Extension) | ₹1530 |

| T4 | 200% | ₹1798 |

| T5 | 261.8% | ₹2231 |

Note: This table was last updated on Thu, 21 Dec 2023.

Making Informed Investment Decisions

For any stock, reaching an all-time high is a significant milestone. Still, conducting thorough research and considering various factors is essential before making investment decisions. To make informed choices that align with your investment goals and risk tolerance, one needs to analyse the company’s fundamentals, industry trends, management’s strategy, and overall market conditions.

Company’s Financial Health

- In 2022, Aurobindo Pharma had a debt of ₹ 5286 crores covered by a comparatively negligible free cash flow of ₹ 18.37 crores and cash & equivalents of ₹ 4399 crores. In just 1 year, its debt increased by 61.20%, whereas free cash flow reduced by a whopping 99.20%, and cash & equivalents increased by a negligible percentage.

- In the short term, it has a liability of ₹ 11494 crores covered by assets of ₹ 21460 crores. The assets of ₹ 18430 crores cover its long-term liabilities of ₹ 1544 crores. It may need to sell a few of its short-term assets to reduce its debt level and increase its free cash flow.

Industry Outlook

- In the pharma sector, there are many drugs that are being researched to find better cures for already curable diseases and find cures for diseases that are not curable yet. Even though Indian companies are focussing mostly on generic drugs for exports, in future, they need to increase their spending on research & development to make India a superpower in manufacturing innovative drugs.

- Pharmaceutical companies are facing immense competition on an international level, so they need to adapt to dynamic pricing models based on customer demand for specific drugs to keep their products competitively priced for increased sales.

- Due to globalisation, the product cycle related to sourcing raw materials, production of drugs and consumption by the end user is not limited to the same country. To make this cycle continuous, there is a need for efficient supply chain management, especially during global challenges such as inflation, geopolitical issues, etc.

Market Sentiment

The favourable trends in the pharmaceutical industry have played a crucial role in Aurobindo Pharma’s recent surge to a new all-time high of ₹ 1097.8. The company’s positive earnings report in Q2 FY24 is a major influencer for the optimistic investors’ sentiment. The company’s commitment to good financial health and sustainability is clearly visible through the financially prudent decision to reduce the dividend payout ratio due to increasing debt & reducing cash flow. Analyst’s ratings also paint a positive picture up to the target of ₹ 1201. Investors need to conduct detailed research, considering factors like company fundamentals, industry trends, and financial health, to make informed investment decisions.