Ceat Share Price History & Returns (1990 To 2024)

Show Table of Contents

Table of Contents

- 1: Ceat Share Highlights

- 1.1: 52-Week High Low

- 1.2: All Time High

- 2: Short Info About Ceat

- 3: Ceat Recent Performance

- 4: Ceat Share Price Chart From 1990 to 2024

- 5: Ceat Share Price History Table From 1990 to 2024

- 6: Analyzing the Impact of Investing in Ceat

- 6.1: Ceat Share Returns In Last 5 Years

- 6.2: Ceat Share Returns In Last 10 Years

- 6.3: Ceat Share Returns In Last 15 Years

- 6.4: Ceat Share Returns In Last 20 Years

- 6.5: Ceat Share VS FD (Normal) VS FD (Compounding)

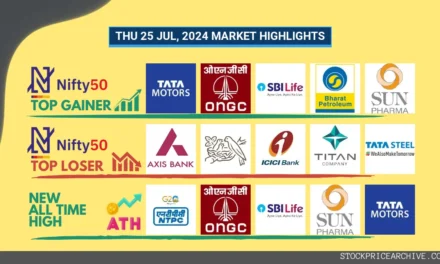

Ceat Share Highlights

As of Fri 26 Jul 2024, Ceat Share price is ₹2,609.55 which is ₹384.20 below 52-week high of ₹2,993.75 and ₹553.20 above 52-week low of ₹2,056.35

52-Week High Low

- Ceat 52-Week High is ₹2,993.75 occured on Fri 23 Feb 2024

- Ceat 52-Week Low is ₹2,056.35 occured on Mon 09 Oct 2023

All Time High

- The all-time high or the highest price that Ceat shares have ever touched was ₹2,993.75 and this occurred on Fri 23 Feb 2024.

- The highest closing price at which Ceat shares have ever closed was ₹2,916.35 recorded on Fri 23 Feb 2024.

Stay ahead of the market! Get instant alerts on crucial market breakouts. Don't miss out on key opportunities!

Your phone number will be HIDDEN to other users.

Advertisement

Short Info About Ceat

CEAT Ltd.: The Tyre Giant with a Global Footprint

Tyre is considered one of the most important inventions of humankind. Over thousands of years, a vast difference was created between the first tyre and the tyre used today, which became possible due to continuous research and development. With over 60 years of experience, CEAT is one of India’s top tyre makers.

1924

CEAT International was commissioned at Turino in Italy and started by manufacturing cables for telephones and railways.

1958

CEAT Tyres of India was incorporated.

1982

CEAT Tyres of India came under the control of RPG Group.

1990

The name of the company was changed to CEAT Ltd.

The name CEAT is the acronym of an Italian company Cavi Elettrici e Affini Torino, which means Electrical Cables and Allied Products of Turin. CEAT got under the absolute control of an Indian company when Rama Prasad Goenka(RPG) Group took it over. This group is headed by Harsh Goenka, a family member of the renowned Goenka business house. It provides products and services in 110+ countries.

It is involved in the manufacturing of tyres for cars, SUVs, bikes, scooters, etc. In 2014, to comply with the ICC regulations for the companies that display their logo on sporting equipment, CEAT started manufacturing bats up to 10K a year. Various indices have it as its constituent, such as the Nifty 500, Nifty Smallcap, etc.

CEAT is providing speed not only to the Indian economy but also to the wealth creation for its investors, visible in its historical share price.

Ceat Recent Performance

Over the past 25 trading days, the value of Ceat's stock has increased by ₹90.70 (+3.60%). On 21 Jun 2024, its one share was worth ₹2518.85 and by 26 Jul 2024, the value jumped to ₹2609.55. During this period it created a highest high of ₹2920.00 and lowest low of ₹2407.55.

Below Image represents line chart of daily close price of Ceat, helping you visualize how the price has changed day by day.

Advertisement

Ceat Share Price Chart From 1990 to 2024

Ceat Share Price History Table From 1990 to 2024

Advertisement

| Year | Ceat | YOY Chg% | ↑High - ↓Low |

|---|---|---|---|

| 1990 | ₹65.76 | - | ↑ ₹122 ↓ ₹61.23 |

| 1991 | ₹106.58 | 62% | ↑ ₹136 ↓ ₹55.56 |

| 1992 | ₹102.05 | -4.3% | ↑ ₹290 ↓ ₹86.17 |

| 1993 | ₹105.45 | 3.3% | ↑ ₹115 ↓ ₹61.68 |

| 1994 | ₹108.85 | 3.2% | ↑ ₹145 ↓ ₹86.17 |

| 1995 | ₹58.96 | -45.9% | ↑ ₹113 ↓ ₹54.88 |

| 1996 | ₹52.61 | -10.8% | ↑ ₹113 ↓ ₹46.49 |

| 1997 | ₹21.32 | -59.5% | ↑ ₹69.85 ↓ ₹16.33 |

| 1998 | ₹20.86 | -2.2% | ↑ ₹34.47 ↓ ₹15.60 |

| 1999 | ₹42.36 | 103% | ↑ ₹88.89 ↓ ₹15.24 |

| 2000 | ₹34.38 | -18.9% | ↑ ₹69.07 ↓ ₹21.77 |

| 2001 | ₹20.73 | -39.8% | ↑ ₹36.15 ↓ ₹13.42 |

| 2002 | ₹30.84 | 48.7% | ↑ ₹49.21 ↓ ₹19.96 |

| 2003 | ₹63.90 | 107.1% | ↑ ₹69.85 ↓ ₹22.68 |

| 2004 | ₹52.11 | -18.5% | ↑ ₹66.90 ↓ ₹25.58 |

| 2005 | ₹72.00 | 38.1% | ↑ ₹104 ↓ ₹48.53 |

| 2006 | ₹123.95 | 72.1% | ↑ ₹139 ↓ ₹55.90 |

| 2007 | ₹209.35 | 68.8% | ↑ ₹244 ↓ ₹104 |

| 2008 | ₹38.90 | -81.5% | ↑ ₹198 ↓ ₹32.90 |

| 2009 | ₹145.50 | 274% | ↑ ₹190 ↓ ₹31.00 |

| 2010 | ₹133.65 | -8.2% | ↑ ₹195 ↓ ₹124 |

| 2011 | ₹73.55 | -45% | ↑ ₹141 ↓ ₹66.20 |

| 2012 | ₹105.25 | 43% | ↑ ₹125 ↓ ₹72.05 |

| 2013 | ₹320.65 | 204.6% | ↑ ₹338 ↓ ₹87.15 |

| 2014 | ₹863.00 | 169.1% | ↑ ₹1009 ↓ ₹266 |

| 2015 | ₹1052.50 | 21.9% | ↑ ₹1318 ↓ ₹596 |

| 2016 | ₹1162.90 | 10.4% | ↑ ₹1422 ↓ ₹731 |

| 2017 | ₹1950.70 | 67.7% | ↑ ₹2030 ↓ ₹1070 |

| 2018 | ₹1306.20 | -33.1% | ↑ ₹2030 ↓ ₹983 |

| 2019 | ₹988.80 | -24.3% | ↑ ₹1319 ↓ ₹731 |

| 2020 | ₹1079.35 | 9.1% | ↑ ₹1249 ↓ ₹601 |

| 2021 | ₹1214.20 | 12.4% | ↑ ₹1763 ↓ ₹1067 |

| 2022 | ₹1641.40 | 35.1% | ↑ ₹1981 ↓ ₹890 |

| 2023 | ₹2427.00 | 47.8% | ↑ ₹2642 ↓ ₹1357 |

| 2024 | ₹2609.55 | 7.5% | ↑ ₹2655 ↓ ₹2575 |

Analyzing the Impact of Investing in Ceat

Ceat Shares price in the year 1990 was ₹65.76. If you had invested ₹10,000 in Ceat Shares in 1990, in 34 years, your investment would have grown to ₹3.96 Lakh by the end of 2024. This represents a positive return of 3868.2% from 1990 to 2024, with a compound annual growth rate (CAGR) of 11.4%.

Advertisement

Also Read: UltraTech Cement Year Wise Share Price History From IPO to 2024

Ceat Share Returns In Last 5 Years

- Its highest share price in the last 5 years was: ₹2,655.25 and lowest was: ₹601.5

- Ceat Shares price in 2019 was ₹988.8

- By 2024, its share price rose to ₹2,609.55

- It gave a positive return of over 163% with a CAGR of 21.4% over the last 5 years

- If you had invested ₹10,000 in Ceat in 2019 then in 5 years, your investment would have grown to ₹26,391 by 2024, which is 2.63 times of your initial investment.

Ceat Share Returns In Last 10 Years

- Its highest share price in the last 10 years was: ₹2,655.25 and lowest was: ₹266

- Ceat Shares price in 2014 was ₹863

- By 2024, its share price rose to ₹2,609.55

- It gave a positive return of over 202% with a CAGR of 11.7% over the last 10 years

- If you had invested ₹10,000 in Ceat in 2014 then in 10 years, your investment would have grown to ₹30,238 by 2024, which is 3.02 times of your initial investment.

Ceat Share Returns In Last 15 Years

- Its highest share price in the last 15 years was: ₹2,655.25 and lowest was: ₹31

- Ceat Shares price in 2009 was ₹145.5

- By 2024, its share price rose to ₹2,609.55

- It gave a positive return of over 1693% with a CAGR of 21.2% over the last 15 years

- If you had invested ₹10,000 in Ceat in 2009 then in 15 years, your investment would have grown to ₹1.79 Lakh by 2024, which is 17.93 times of your initial investment.

Ceat Share Returns In Last 20 Years

- Its highest share price in the last 20 years was: ₹2,655.25 and lowest was: ₹25.58

- Ceat Shares price in 2004 was ₹52.11

- By 2024, its share price rose to ₹2,609.55

- It gave a positive return of over 4907% with a CAGR of 21.6% over the last 20 years

- If you had invested ₹10,000 in Ceat in 2004 then in 20 years, your investment would have grown to ₹5 Lakh by 2024, which is 50.07 times of your initial investment.

Ceat Share VS FD (Normal) VS FD (Compounding)

You might wonder which option is better: shares, fixed deposits (FDs) or compounding FDs. Let’s compare them and see how they differ.

- Shares: Units of ownership in a company can benefit from its profits or losses.

- FDs: Deposits you make with a bank or a financial institution for a fixed time and at a fixed interest rate.

- Compounding FDs: Similar to FDs but with one difference: the interest is reinvested into the principal amount instead of being paid out.

If you invested ₹10,000 rupees each in these 3 options in :

| Year | Ceat Investment | FD Normal Investment | FD Compond Investment |

|---|---|---|---|

| 1990 | ₹10,000 | ₹10,000 | ₹10,000 |

Then today, your investment would have become this much in each option: | |||

| 2024 | ₹3,88,380.57 | ₹30,400 | ₹72,510.25 |

[Click/Touch on line to show data]

For more insights into Ceat, explore these additional resources:-

Reference:

- CEAT Ltd. CEAT – About company

- Economic Times CEAT produces cricket bats

- Economic Times CEAT company history

- Wikipedia CEAT – Wiki