Home / Kalyan Jewellers Creates A New All Time High 243 Up In 8 Mths

Kalyan Jewellers Creates A New All-Time High: 243% Up in 8+ Mths

Show Table of Contents

Table of Contents

- 1: Chart: Kalyan Jewellers All Time High & 52 Week Low as of 28 Dec 2023

- 2: Kalyan Jewellers’ Record Surge to a New All-Time High

- 2.1: Factors Contributing to a Stock’s All-Time High

- 2.2: Positive Earnings Reports

- 2.3: Favourable Industry Trends

- 2.4: Positive Analyst Ratings

- 2.5: Potential Scenarios Following an All-Time High

- 3: Kalyan Jewellers Stock Analysis: Potential Supports and Targets

- 3.1: KEY PERFORMANCE METRICS

- 3.1.1: Kalyan Jewellers Fibonacci Retracement Or Support levels

- 3.1.2: Kalyan Jewellers Fibonacci Extensions Or Target levels

- 4: Making Informed Investment Decisions

- 4.1: Company’s Financial Health

- 4.2: Industry Outlook

- 4.3: Market Sentiment

KALYAN JEWELLERS:Share Price HistoryKALYANKJIL FinancialsPrice PredictionDividend HistoryNo BonusNo Split

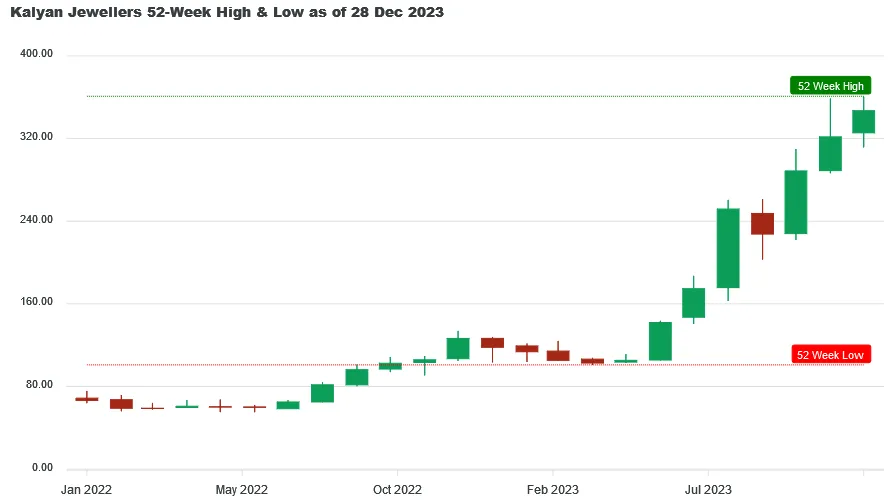

Chart: Kalyan Jewellers All Time High & 52 Week Low as of 28 Dec 2023

Kalyan Jewellers hit its 52 week low of ₹100.95 on 27 Apr 2023 and from there it move to ₹361.00 creating a brand-new All Time High on 28 Dec 2023, giving a whopping 243.73% return in just 8 months and 1 days.

If you had invested ₹10,000 at its 52-week low price, your investment would have grown to ₹34,373 by 28 Dec 2023. This represents a gain of ₹24,373 in just 8 months and 1 days. Given KALYANKJIL's strong recent performance, Lets find out what opportunities lies ahead for KALYANKJIL

If you had invested ₹10,000 at its 52-week low price, your investment would have grown to ₹34,373 by 28 Dec 2023. This represents a gain of ₹24,373 in just 8 months and 1 days. Given KALYANKJIL's strong recent performance, Lets find out what opportunities lies ahead for KALYANKJIL

Stay ahead of the market! Get instant alerts on crucial market breakouts. Don't miss out on key opportunities!

Your phone number will be HIDDEN to other users.

Kalyan Jewellers’ Record Surge to a New All-Time High

The all-time high of Kalyan Jewellers can be a result of many factors. Its previous all-time high was made on 09 November 2023 at ₹ 359.15. It took 1 month and 19 days to create a new all-time high at ₹ 362 on 28 December 2023. In between, it made a low of ₹ 304.1 on 30 November 2023, implying a correction of over 15%. It may represent a change in the investors’ sentiment about the company due to improved financial condition or may represent overvaluation. Let’s go through the factors contributing to its all-time high.

Factors Contributing to a Stock’s All-Time High

Positive Earnings Reports

- In the last 5 quarters, its revenue has seen a double-digit growth year-on-year. In Q2 FY24, its revenue increased by 27.11% year-on-year and reached a record high of ₹ 4415 crores.

- Compared to its revenue, which increased by 0.8% QOQ, the operating expenses saw a reduction of 14.28%. It may mean that the company has become operationally more efficient.

- Its profit margin in 2022 was the highest in the last 5 years. It had a net margin of 3.08%, which resulted in a net income of ₹ 433 crores.

Favourable Industry Trends

- Kalyan Jewellers has already captured a significant portion of the branded jewellery business in south India, and now it is focused on expansion in the non-south market. Considering the growth opportunities available in the domestic market, its growth is expected to continue, and business will become geographically diversified.

- The Middle East is considered one of the biggest gold markets in the world. Kalyan Jeweller chose it as a strategic location for its international presence as a lot of Indian people live in the mentioned area, so it will not be difficult for it to grab people’s attention.

- As people become more accustomed to buying expensive products online, a new growth avenue for the jewellery sector will open. Kalyan Jewellers can benefit from the trend by increasing its online presence and providing comparatively low-priced products to onboard customers, which can be later upgraded to higher-end products.

Positive Analyst Ratings

According to Simply Wall Street, based on the discounted cash flow model, the fair value of Kalyan Jewellers’ share is ₹ 79.51. However, its CMP is ₹ 352.15, which means the stock is 342.9% overvalued. It has a price-to-earnings ratio of 72.8x, which is higher than the peer average of 51.2x, thus making it overvalued. The company has high-quality earnings, but its current net profit margin of 3.1% is lower than the previous year’s value of 3.2%. Its earnings are expected to grow at 33.1% annually, whereas the revenue may grow by 24.7% annually.

Potential Scenarios Following an All-Time High

(Based on the chart of 1-month timeframe)

Converting numbers and candles into information can provide us with the market’s stance on the stock, which may help us make correct investment decisions. Since the listing of Kalyan Jewellers in March 2021, it has made only 3 all-time highs after a gap of at least a month. In May 2023,, it started its bull rally with higher highs and higher lows every month. We can expect the trends to continue so the investors may enter the stock at the price of their liking but keep the stop loss at the low made in the previous month.

Kalyan Jewellers Stock Analysis: Potential Supports and Targets

Thu 28 Dec 2023 - In a remarkable market development, Kalyan Jewellers has soared to ₹361.00, setting a brand-new All Time High record! With this surge, there are chances of it becoming volatile, as many investors may like to book their profits by exiting or closing their positions. At this time potential investors and current stakeholders should keep an eye for opportunities for entry or exit.

Below you will find Kalyan Jewellers's metrics highlight, potential support and targets derived using Fibonacci Retracement and Extensions method, where Golden Ratio is assumed to be a good support (entry point) and Golden Extension to be good resistance (target point)

KEY PERFORMANCE METRICS

| Metrics | Value | Occured On |

|---|---|---|

| Close Price | ₹347.00 | Thu, 28 Dec 2023 |

| 52 Week High | ₹361.00 | Thu, 28 Dec 2023 |

| 52 Week Low | ₹100.95 | Thu, 27 Apr 2023 |

| All Time High | ₹361.00 | Thu 28 Dec 2023 |

The above table shows that the close price of Kalyan Jewellers on Thu, 28 Dec 2023 was ₹347.00. Notably, the All-Time High is same as the 52-Week High, indicating that the all-time high was achieved recently and it cloud be a strong resistance level which would need great upward momentum to break.

It's possible that some investors might consider booking profits near the 361.00 mark, which could apply downward pressure on the stock price.

But what does this newly created milestone signify for potential investors? Lets find out.

Kalyan Jewellers Fibonacci Retracement Or Support levels

For those considering an entry, the Golden Ratio (61.8%) retracement level of ₹200 offers a promising point, given the likelihood of a pullback from these levels as new investors might come in at these levels.

| Retracement or Support Levels | Values | |

|---|---|---|

| S1 | 23.6% | ₹299 |

| S2 | 38.2% | ₹261 |

| S3 | 50.0% | ₹230 |

| S4 | 61.8% (Golden Ratio) | ₹200 |

| S5 | 78.6% | ₹156 |

| S6 | 52 Week Low | ₹100 |

Note: This table was last updated on Thu, 28 Dec 2023.

Kalyan Jewellers Fibonacci Extensions Or Target levels

For those considering an exit, the Golden Extension (161.8%) level of ₹521 offers a promising point, given the likelihood of a downward momentum from these levels as investors might start booking their profits at these levels.

| Extensions or Target Levels | Values | |

|---|---|---|

| T1 | 52 Week High | ₹361 |

| T2 | 138.2% | ₹460 |

| T3 | 161.8% (Golden Extension) | ₹521 |

| T4 | 200% | ₹621 |

| T5 | 261.8% | ₹781 |

Note: This table was last updated on Thu, 28 Dec 2023.

Making Informed Investment Decisions

For any stock, reaching an all-time high is a significant milestone. Still, conducting thorough research and considering various factors is essential before making investment decisions. To make informed choices that align with your investment goals and risk tolerance, one needs to analyze the company’s fundamentals, industry trends, management’s strategy, and overall market conditions.

Company’s Financial Health

- In 2022, Kalyan Jewellers had a debt of ₹ 4295 crores covered by a free cash flow of ₹ 254 crores and cash & equivalents of ₹ 270 crores. It shows a vast difference between the debt and funds, which makes it essential for the company to increase the amount under free cash flow or cash & equivalents.

- In the short term, it has a liability of ₹ 6369 crores covered by assets of ₹ 8382 crores. The assets of ₹ 2331 crores cover its long-term liabilities of ₹ 710 crores. The company can easily maintain its financial health due to the substantial difference between assets and liabilities.

Industry Outlook

- The industry can see an increased demand for its products as people’s disposable income increases with the growth of the Indian economy. Gold, real estate and equity are the three investment options that investors choose for good returns. We may see some products in line with the expectation of people looking for gold just as an investment option.

- Since their inception, sovereign gold bonds have attracted many investors looking for gold as an investment option. As they become available more frequently and the lock-in period gets reduced, the gold industry can have their sales reduced from the section of customers that buy gold as an investment option.

Market Sentiment

On 28 December 2023, Kalyan Jewellers made a new all-time high, which can be attributed to factors such as positive earnings reports, favourable industry trends, etc. The revenue of the company has shown continuous growth with a comparatively smaller increase in operational expenses, which means that the company is also focused on achieving operational efficiency. However, investor caution is advised due to the company’s high valuation compared to the peer average and its financial health, including a significant debt covered by lower free cash flow and cash equivalents. The future growth trajectory of the stock depends on its ability to balance growth and financial stability along with the broader industry outlook. Investors need to conduct detailed research, considering factors like company fundamentals, industry trends, and financial health, to make informed investment decisions.